Market Insight

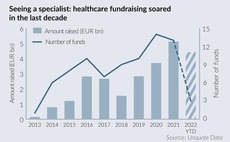

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

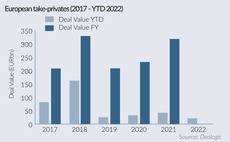

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

PE activity reaches EUR 392bn in record-breaking 2021

Q4 may have shown signs of a market slowdown, but 2021 nevertheless stands out as a phenomenal year for PE deployment across Europe

Average fund size reaches new heights amid stark market bifurcation

Average buyout fund close for 2021 stands at EUR 1.33bn, more than double the EUR 629m recorded in 2017

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

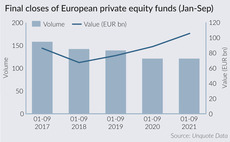

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

European IPOs reach seven-year high in first nine months of 2021

Sponsors have been on the ball when it comes to capitalising on the IPO window this year, according to Dealogic data

Mega-rounds fuel record H1 for venture and growth

Largest rounds inked in the first six months of 2021 read like a veritable Who's Who of European fintech heavyweights

UK buyout activity cools off in second quarter

While buyout activity fell more sharply in the UK compared to other European markets in Q2, dealflow remained very strong by historical standards

European PE buyout activity sets new record in H1

Hectic first quarter drove an unprecedented spike in deal activity, while aggregate value is just shy of hitting an all-time high

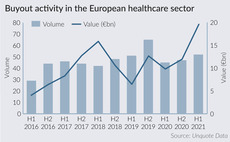

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

PE-backed IPOs on track for best year since 2017

This year has already seen 26 portfolio companies listing, with a total offering volume approaching тЌ12.7bn

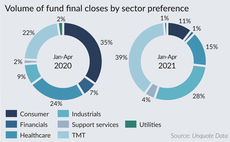

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

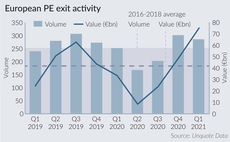

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Tech overtakes consumer in Italy

Numerous Italian GPs with a generalist approach have reshaped their activity towards the tech sector

Buyout rankings: who invested the most in Europe in Q1 2021?

Unquote tallies the top 10 most active GPs across the European buyout space in the first quarter

SBOs, mega-deals fuel strong Q1 for French buyouts

While the sharp quarter-on-quarter rebound of late 2020 was not replicated, the French market remained buoyant in Q1

UK buyout rankings: who invested the most in Q1

Unquote tallies the top 10 most active GPs across the UK buyout space in an exceptionally busy first quarter

Quiet market for final closes in Q1, as backlog of funds on the road grows

The number of final closes for European PE funds was down by 22% year-on-year in Q1 2021

UK buyout activity sets new record in Q1

UK buyout market is truly back in full swing, according to preliminary figures from Unquote's proprietary database

European fund launches off to slow start in 2021

Number of PE funds launched by European managers in Q1 this year is significantly down on the volume recorded for the same period in 2020