Research

Q1 Barometer: Signs of a brighter future after dark times for European PE

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Q4 Barometer: deal count remains steady amid tough environment

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Clearwater Multiples Heatmap: Valuations ease as PE deals slow down

After a record quarter, Q3 2022 sees sponsor transactions fall sharply amid challenging macro environment

Q3 Barometer: M&A softens across entire PE spectrum

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Clearwater Multiples Heatmap: PE deals at record value in Q2 as macro pressure mounts

Sponsor transactions in Europe surged to an all-time high with TMT and the UK leading the way

Q2 Barometer: Value and volume bifurcation sets in

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Clearwater Multiples Heatmap: PE activity holds up amid war, inflation woes

Record levels of dry powder continue to bolster the resilience of the buyout market in Q1 2022

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

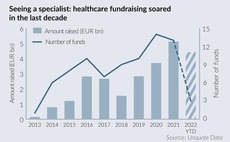

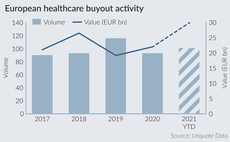

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

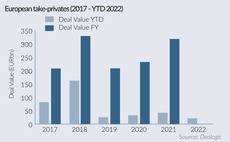

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

PE activity reaches EUR 392bn in record-breaking 2021

Q4 may have shown signs of a market slowdown, but 2021 nevertheless stands out as a phenomenal year for PE deployment across Europe

Q3 Barometer: PE scales new heights

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

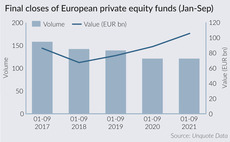

Average fund size reaches new heights amid stark market bifurcation

Average buyout fund close for 2021 stands at EUR 1.33bn, more than double the EUR 629m recorded in 2017

Multiples Heatmap: TMT deals inked in Q3 pass 19x mark

Average entry multiples were again pushed into record territory in Q3 on the back of a still-buoyant M&A market

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

Leveraged loans issuance sets new record

High-yield bonds backing LBOs followed a different route, with volume decreasing 67% from Q2

DACH VC deal value doubles year on year

VCs have backed DACH region deals with an aggregate value of EUR 15.4bn in 2021 to date

2021 European PE exits already exceeding full 2020 tally

GPs are clearly looking to seize the initiative and clear out portfolios amid a general push to ink deals on the buy-side

European ESG market to hit EUR 1.2trn by 2025 – survey

Segment could account for between 27% and 42% of private markets' asset base, up from 15% in 2020, says PwC

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate