CEE

BHM Group builds on PE strategy, eyes European medtech and renewable energy acquisitions

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Trind VC plans up to five early-stage investments in next six months

VC has deployed around 10% of its second, EUR 55m fund and plans to invest in up to 40 startups

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

Actera Group explores strategic options for Celebi Ground Handling

Several investors placed bids for the company in 2022 but mismatch in pricing didn't lead to a deal

Iron Wolf Capital targets EUR 70m for second vehicle

Baltic investor anticipates early 2024 launch and will focus on early-stage AI and deeptech startups

Siena aims to hold new VC secondaries fund first close in late 2023 or early 2024

Secondary investments specialist will target EUR 30m to EUR 50m for new fund

Credo Ventures sees activity uptick, plans further deals in 2023 with EUR 75m fourth fund

Czech VC firm's latest vehicle is around 50% deployed and expects to make 25-30 deals in total

VC Profile: Kogito Ventures in the market with new early-stage fund, targets EUR 40m

Lux-registered UPWIND VC has already secured EUR 10m in commitments; Polish GP aims to kick of deployment in 2024

Turkven exits MNG Kargo, expects partial exit from Mikro Yazilim

Turkish GP sold its majority stake in Turkish parcel delivery business and could make a second exit to PE-backed TeamSystem

Women in PE: Abris Capital Partners' Nachyla on newly launched fundraise and portfolio priorities amid geopolitical challenges

Partner Monika Nachyla outlines the CEE-based GP's fundraising and portfolio development plans

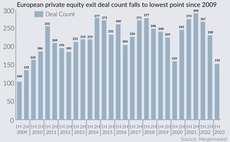

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

Arcven Capital to raise debut VC secondary purchase fund with EUR 80m target

VC aims to provide liquidity to existing startup shareholders, investing EUR 200,00-EUR 2m at discounted valuations

Wellington eyes late-stage growth opportunities with new USD 2.6bn fund

GP seeks to address capital needs pre-IPO or sale and anticipates a diverse portfolio for fourth fund

The Bolt-Ons Digest - 3 July 2023

Unquoteтs selection of the latest add-ons with Palatine's Anthesis, Nordic Capital's Regnology, Waterland's Janssen and more

Unquote Private Equity Podcast: PE perspectives from Berlin

Unquoteтs Min Ho and Rachel Lewis digest the key takeaways from this yearтs SupeReturn

EU Foreign Subsidies rules hold specific challenges for PE

Sovereign wealth funds and pension funds commitments may trigger EC attention under new EU foreign subsidies regulation

Omorika Ventures plans year-end first close for EUR 50m southeastern Europe-focused fund

VC firm plans to build a portfolio of 20-25 startups and expects to secure a EUR 10m first close

Eterus Capital lines up dealflow with EUR 10m left to deploy from EUR 40m fund

Slovak PE firm is “seriously looking at“ more than 10 potential investments

European LPs bullish on 2024 PE fund vintages – Coller Capital

LPs remain positive on PE but are considering increasing infra and private credit allocations, latest survey shows

From slash-and-burn to grow-and-earn: private equity changes tack

Rising cost of capital means value-creation will be vital for next decade of private equity, SuperReturn participants said

Carlyle acquires Meopta

GP plans to support Czech-American optical products manufacturer’s international expansion

Adams Street secures USD 3.2bn for newest secondaries programme amid LP stakes dealflow uptick

Private markets investor has seen LP stakes increase as a proportion of its deployment over the past year, partner Jeff Akers said