Nordics

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

Trind VC plans up to five early-stage investments in next six months

VC has deployed around 10% of its second, EUR 55m fund and plans to invest in up to 40 startups

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

Main Capital's Assessio to be sold to Pollen Street

Recruitment software company tripled in revenue under Main Capital’s ownership

Norstat owner Triton Partners explores sale via William Blair

GP has owned the Norway-headquarterd market research business for almost four years

Consilium sponsor Nordic Capital to distribute IMs next month

Safety technologies producer was acquired in a SEK 3bn (EUR 287m) take-private in 2021

VC Spotlight: Climentum Capital fund to announce 10th investment this month; aims for final close at EUR 75m end-Sept

The GP expects to launch its second fund in 2025 with a target size of EUR 100m-EUR 125m

CapMan Managing Partner Johan Pålsson to depart

PУЅlsson resigns from management effective immediately; to stay as buyout partner until February 2024

PAI Partners nears close for EUR 7bn Fund VIII following timeline extension

France-headquartered firm is expected to close the vehicle in November 2023 amid a tough fundraising climate

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

Puzzel sponsor Marlin approaches buyers for exit via William Blair

GP bought the Norway-based call-centres-as-a-service business in 2019 from Herkules Capital

Founders Future to kick off EUR 80m-EUR 100m fund this year as 'now is the best time to invest in seed funding'

French VC firm is prepping a new vehicle which will invest EUR 3m-EUR 10m in companies it has already invested in, founder Marc Menasé said.

Main Capital-backed Assessio sale enters second round with strategics among shortlisted bidders

Final bids for Swedish recruitment services platform were due last week; process kicked off in April

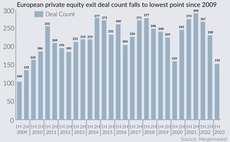

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

RelyOn Nutec sponsor Polaris preps autumn sale via Houlihan Lokey

GP bought the safety training provider, then known as Falck Safety Services, in a carve-out in 2018

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

Nordic Capital reaps around 6x money in Macrobond SBO

US-based tech sponsor Francisco Partners set to acquire the Swedish financial data provider

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

Macrobond owner Nordic Capital collects initial bids in wide sale process

Nordic Capital is expected to collect non-binding offers for Swedish financial data company Macrobond this week, two sources familiar with the situation said.

Summa Equity's Documaster tipped as likely exit candidate for 2024

GP bought a majority stake in Norway-based digital document platform provider in 2017

Wellington eyes late-stage growth opportunities with new USD 2.6bn fund

GP seeks to address capital needs pre-IPO or sale and anticipates a diverse portfolio for fourth fund

The Bolt-Ons Digest - 3 July 2023

Unquoteтs selection of the latest add-ons with Palatine's Anthesis, Nordic Capital's Regnology, Waterland's Janssen and more

RTP Global holds final close for fourth fund on USD 1bn

Fundraise is New York-headquartered early-stage venture capital firmтs largest to date

Unquote Private Equity Podcast: PE perspectives from Berlin

Unquoteтs Min Ho and Rachel Lewis digest the key takeaways from this yearтs SupeReturn