Analysis

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

EU FSR could impact PE fundraising with potential rise in 'clean funds'

FSR could lead GPs to create funds without foreign LPs; red tape around sovereign wealth funds likely

IPO offers CVC chance to become multi-asset consolidator

Potential IPO also offers monetisation solution for founders and GP stakes investor Blue Owl

VC Profile: Possible Ventures lines up frontier tech deals halfway through fresh EUR 60m fundraise

Germany-based pre-seed investor is set to hold a first close for its third fund in mid-September

CMA scrutiny of high-leverage PE divestment purchases expected to increase

PE could stand to lose its historic advantage with heightened regulatory baggage

GP Profile: Apheon builds on family roots, mulls exits and reinvestment opportunities

Belgian GP, formerly known as Ergon, to continue to target family- and entrepreneur-owned European businesses

VC Profile: Kogito Ventures in the market with new early-stage fund, targets EUR 40m

Lux-registered UPWIND VC has already secured EUR 10m in commitments; Polish GP aims to kick of deployment in 2024

Turning the tables – an M&A downturn means investment banks are now targets themselves

Some dealmakers with healthy balance sheets and willingness to go countercyclical are pursing acquisitions

VC Profile: RTP Global gears up to deploy largest fund to date, remains bullish on breakout opportunities

Partner Gareth Jefferies discusses early-stage deployment plans and advantages of supporting startups throughout their lifecycle

GP Profile: Baird Capital puts lower-middle-market niche and global expansion offering to work

GPтs flexible deal structure proposition resonates particularly well with founders in the current environment, Michael Holgate told Unquote

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

Women in PE: Earth Capital's Bezuidenhoudt and Hockley on 2024 fund launch progress and co-investment pipeline

UK-based impact investorтs female leaders discuss deployment plans and the advantages of its syndicate co-investment strategy

It's a new generation: Emerging PE professionals are propelling their careers with ESG – PE Forum Italy

Bridging generational gaps and forging ESG agendas can allow young practitioners to make their mark

Women in PE: Abris Capital Partners' Nachyla on newly launched fundraise and portfolio priorities amid geopolitical challenges

Partner Monika Nachyla outlines the CEE-based GP's fundraising and portfolio development plans

Thematic funds are PEs' secret weapon for times of change, volatility – PE Forum Italy

Betting on secular trebds and corporate partnerships, GPs are finding ways to deploy in a challenging market

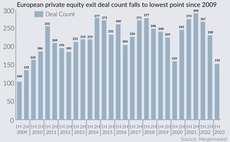

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

PE purchases stall in Italy as buyers lose faith – PE Forum Italy

PE players are hoping that valuation expectations will align in 2H 2023, easing dealmaking backlog

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

GP Profile: NB Renaissance outlines acquisition and exit plans in final stretch of current fund deployment

Nearing full deployment for its third fund, Italian private equity firm is prepping one more deal and at least one exit by year-end

VC Profile: NetScientific's EMV gears up for debut fund targeting early-stage deep-tech startups

UK-based investment platform will step up investments in existing portfolio, while securing commitments for its thematic fund by year-end

Many-headed Hydra: Private markets manager consolidation rears its head

Multi-asset managers set to roll-up credit, infrastructure and secondaries players to add strategies for scale

Unquote Private Equity Podcast: PE perspectives from Berlin

Unquoteтs Min Ho and Rachel Lewis digest the key takeaways from this yearтs SupeReturn

EU Foreign Subsidies rules hold specific challenges for PE

Sovereign wealth funds and pension funds commitments may trigger EC attention under new EU foreign subsidies regulation