Data Snapshot

Slice of pie: New entrants gobble up GP stakes in Europe

Armen, Hunter Point Capital, GP House and Axa IM rustle up new minority investments, as Inflexion and Coller sell

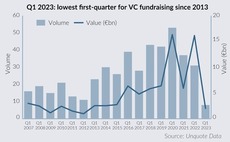

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

Strategics pull back from PE sales as macro uncertainty bites

Share of trade exits hits lowest point in three years as corporates shore up balance sheets to navigate economic woes

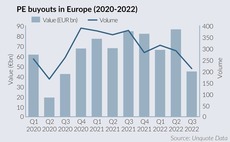

Private equity buyouts hit lowest point since COVID

Amid macro uncertainty, sponsors see EUR 44.6bn deployed across 211 buyouts, in the lowest mark since Q3 2020

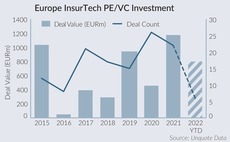

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

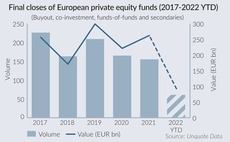

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

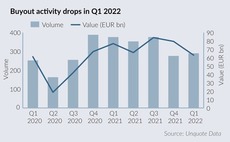

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

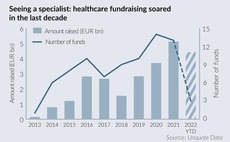

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

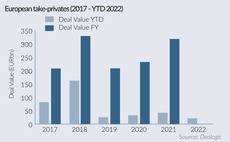

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

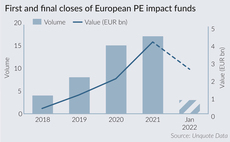

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

PE activity reaches EUR 392bn in record-breaking 2021

Q4 may have shown signs of a market slowdown, but 2021 nevertheless stands out as a phenomenal year for PE deployment across Europe

Average fund size reaches new heights amid stark market bifurcation

Average buyout fund close for 2021 stands at EUR 1.33bn, more than double the EUR 629m recorded in 2017

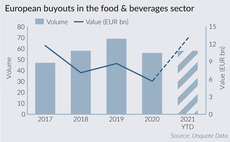

Food and beverage buyouts to reach EUR 13bn in 2021

An average of 44 buyouts totaling EUR 5.1bn were completed in the sector from 2011-2020

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

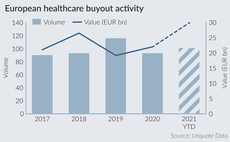

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

DACH VC deal value doubles year on year

VCs have backed DACH region deals with an aggregate value of EUR 15.4bn in 2021 to date

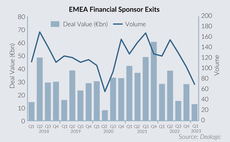

2021 European PE exits already exceeding full 2020 tally

GPs are clearly looking to seize the initiative and clear out portfolios amid a general push to ink deals on the buy-side

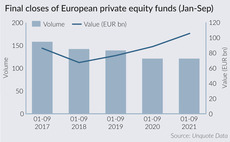

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

European IPOs reach seven-year high in first nine months of 2021

Sponsors have been on the ball when it comes to capitalising on the IPO window this year, according to Dealogic data

French mega-rounds shoot up in 2021

France has already seen as many rounds of EUR 100m and above than in 2019 and 2020 combined, Unquote Data shows