Benelux

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

EU FSR could impact PE fundraising with potential rise in 'clean funds'

FSR could lead GPs to create funds without foreign LPs; red tape around sovereign wealth funds likely

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

Evoco expects portfolio acquisitions, assesses potential exits in 2H23

Switzerland-headquartered GP is currently deploying equity via its EUR 162m Evoco TSE III fund

GP Profile: Apheon builds on family roots, mulls exits and reinvestment opportunities

Belgian GP, formerly known as Ergon, to continue to target family- and entrepreneur-owned European businesses

Turning the tables – an M&A downturn means investment banks are now targets themselves

Some dealmakers with healthy balance sheets and willingness to go countercyclical are pursing acquisitions

Corus Dental sponsors mandate Houlihan Lokey to review options

Upcoming process for Spain-based dental prosthetics company to launch in September

Eurazeo taps Rothschild for DORC exit

Upcoming process for Dutch medical equipment group expected to launch in September

Arcmont eyes up to EUR 10bn in new money for European direct lending strategy

Fresh fundraise would be a significant step up from its previous EUR 6bn European direct lending fund

Golding eyes 2024 final close for latest secondaries fund, targets 'undercapitalised' small- and mid-cap space

Asset manager is targeting EUR 500m and is seeing discounts on both GP-led and LP stakes deals

PAI Partners nears close for EUR 7bn Fund VIII following timeline extension

France-headquartered firm is expected to close the vehicle in November 2023 amid a tough fundraising climate

Active Capital in EUR 150m fundraise; SIF strategy and portfolio companies eye buys

Industrials-focused sponsor expects reshoring trend to generate uptick in opportunities

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

Bencis prepares Kooi for sale via Lincoln

Netherlands-based video surveillance business was founded in 2010 and acquired by Bencis in 2018

CVC raises Europe's largest ever buyout fund, securing EUR 26bn for ninth vehicle

Fund was launched in January 2023 and surpassed its EUR 25bn target, the GP said in a statement

LGT closes fourth global venture capital fund on USD 930m

Primary, co-investment and secondaries vehicle surpassed its USD 750m target

Dutch VC NLC Health aims to raise a further EUR 80m for fourth fund

Plans to back companies created by NLC Venture Builder across medtech, biotech and digital tech

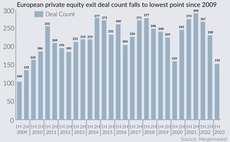

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

BioGeneration Ventures closes Fund V on EUR 150m

LP appetite for healthcare has remained strong in spite of a tough fundraising market

Esquare Capital Partners seeks entrepreneur commitments for second, EUR 25m tech platform

Dutch investor aims to connect entrepreneurs with tech investment appetite to startups seeking capital

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

Dutch sponsor Egeria gears up for new fund launch next year

GP’s 2017-vintage, EUR 800m current fund is expected to be fully deployed within 12-18 months

Wellington eyes late-stage growth opportunities with new USD 2.6bn fund

GP seeks to address capital needs pre-IPO or sale and anticipates a diverse portfolio for fourth fund