Support services

Actera Group explores strategic options for Celebi Ground Handling

Several investors placed bids for the company in 2022 but mismatch in pricing didn't lead to a deal

Main Capital's Assessio to be sold to Pollen Street

Recruitment software company tripled in revenue under Main Capital’s ownership

Norstat owner Triton Partners explores sale via William Blair

GP has owned the Norway-headquarterd market research business for almost four years

CMA scrutiny of high-leverage PE divestment purchases expected to increase

PE could stand to lose its historic advantage with heightened regulatory baggage

Consilium sponsor Nordic Capital to distribute IMs next month

Safety technologies producer was acquired in a SEK 3bn (EUR 287m) take-private in 2021

GP Profile: Apheon builds on family roots, mulls exits and reinvestment opportunities

Belgian GP, formerly known as Ergon, to continue to target family- and entrepreneur-owned European businesses

Dataciders sponsor Auctus mulls sale via Houlihan Lokey

German GP first acquired the local IT services group in May 2019 via Auctus V, a 2019-vintage

WestBridge raises GBP 130m in first close for third fund with debut deal in sight

UK-based PE firm has set GBP 200m hard-cap and target for the vehicle

Unicepta sponsor Paragon mandates Baird for potential exit

GP bought a majority stake in Germany-based media and marketing intelligence provider in 2018

GP Profile: Baird Capital puts lower-middle-market niche and global expansion offering to work

GPтs flexible deal structure proposition resonates particularly well with founders in the current environment, Michael Holgate told Unquote

Bregal eyes local deal origination with new Swiss office

GP's third fund is completing its investment period, with fourth fund registered

Golding eyes 2024 final close for latest secondaries fund, targets 'undercapitalised' small- and mid-cap space

Asset manager is targeting EUR 500m and is seeing discounts on both GP-led and LP stakes deals

Warburg Pincus poaches former Evercore MD to co-head Europe

Andrew Sibbald succeeds Adarsh Sarmam, who will remain a managing director and partner

Turkven exits MNG Kargo, expects partial exit from Mikro Yazilim

Turkish GP sold its majority stake in Turkish parcel delivery business and could make a second exit to PE-backed TeamSystem

PAI Partners nears close for EUR 7bn Fund VIII following timeline extension

France-headquartered firm is expected to close the vehicle in November 2023 amid a tough fundraising climate

Fremman considers return to market in 2024 following newly closed EUR 1bn debut fundraise

Pan-European GP raised its debut fund during the тmost challengingт period for debut funds in recent years

e-Attestations aims to triple size with new Keensight backing

Keensight is investing in the risk management platform via its EUR 1bn fifth fund, which closed in 2019

KKA Partners boasts strong US LP showing in latest EUR 230m fund

Small mid-cap investor avoids pure tech businesses and ongoing ‘bubble’

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

CVC raises Europe's largest ever buyout fund, securing EUR 26bn for ninth vehicle

Fund was launched in January 2023 and surpassed its EUR 25bn target, the GP said in a statement

Montefiore expects 100% re-ups for next EUR 1bn-plus fundraise

Past two fundraises saw funds oversubscribed by 3x on consistent exit track record, CEO Eric Bismuth said

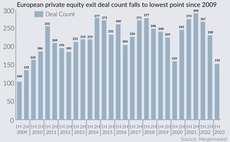

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

RelyOn Nutec sponsor Polaris preps autumn sale via Houlihan Lokey

GP bought the safety training provider, then known as Falck Safety Services, in a carve-out in 2018

Capza sees solid demand for Flex Equity strategy as fifth fund reaches two-thirds deployment

GP is seeking bolt-ons for French consulting firm Neo2 following fresh minority investment, partner Fabien Bernez said