Articles by Harriet Matthews

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

GP Profile: Apheon builds on family roots, mulls exits and reinvestment opportunities

Belgian GP, formerly known as Ergon, to continue to target family- and entrepreneur-owned European businesses

Capvis grapples with EUR 1bn fundraise amid team exodus

Five partners for the Swiss-based GP leave firm in last two years; sponsor started sixth buyout fundraise in early 2023

Golding adds insurance expertise with hire for institutional clients team

Tim Ickenroth joins as director with prior experience at BNP Paribas and UniCredit

WestBridge raises GBP 130m in first close for third fund with debut deal in sight

UK-based PE firm has set GBP 200m hard-cap and target for the vehicle

Travers Smith bolsters funds practice with hire from Proskauer

Tosin Adeyeri joins with particular experience in secondary portfolio transactions

Golding eyes 2024 final close for latest secondaries fund, targets ‘undercapitalised’ small- and mid-cap space

Asset manager is targeting EUR 500m and is seeing discounts on both GP-led and LP stakes deals

PAI Partners nears close for EUR 7bn Fund VIII following timeline extension

France-headquartered firm is expected to close the vehicle in November 2023 amid a tough fundraising climate

Bridgepoint extends Europe VII fundraising timeline to tap 2024 allocations

GP has raised EUR 6bn against its EUR 7bn target but has seen a 67% year-on-year drop in investment income due to fall in exits

Stanley Capital Partners hires two in drive for growth

James Sexton and Frederik Fogtdal will join the mid-market healthcare and resource efficiency-focused GP as principal

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

ICG sells majority stake in With Intelligence to Motive Partners in GBP 400m deal

Sale to specialised financial technology investor follows a competitive process and brings acquirer closer to launch of third fundraise

CVC raises Europe’s largest ever buyout fund, securing EUR 26bn for ninth vehicle

Fund was launched in January 2023 and surpassed its EUR 25bn target, the GP said in a statement

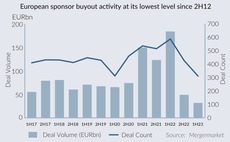

Sluggish PE market struggles with deal execution, braces for pent-up demand wave

Financing challenges and valuation discrepancies have stymied deal count and volume, but hopes pinned on 4Q 2023 and beyond

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Stirling Square relaunches Outcomes First exit with education division sale

GP split the business into education and fostering units last year after an earlier sale attempt

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve O’Hare about the GP’s approach to its recent realisations

Dechert hires Travers Smith’s Kay for funds practice

Sam Kay joins London-based team having spent more than 25 years at Travers Smith

Unquote Private Equity Podcast: PE perspectives from Berlin

Unquote’s Min Ho and Rachel Lewis digest the key takeaways from this year’s SupeReturn

Synova sells minority stake to Bonaccord

Passive minority GP stake deal sees Synova join UK peers including MML and Inflexion in taking on external capital

ICG hires Cestar as global head of credit

Cestar has more than 25 years’ industry experience, including with Credit Suisse in London and New York

MPEP launches fifth buyout fund-of-funds with EUR 300m target

Lower mid-market specialist will continue to apply thorough due diligence for new and existing relationships, seeking persistency of returns

Nordic Alpha Partners secures EUR 150m for second greentech fund

Hardtech sustainability-focused GP expects to continue its fundraise throughout 2023 following its first close and firm's first strategic exit