Consumer

Trind VC plans up to five early-stage investments in next six months

VC has deployed around 10% of its second, EUR 55m fund and plans to invest in up to 40 startups

Ares Management handed keys to two-thirds of UK sponsor's portfolio

Lender provided GBP 500m for three of the GP's deals between 2016 and 2019, Debtwire reported

Exponent divests 'significant' stake in Meadow to Canadian investor

Since 2018, GP has diversified food ingredients company's focus beyond commodity dairy

CMA scrutiny of high-leverage PE divestment purchases expected to increase

PE could stand to lose its historic advantage with heightened regulatory baggage

Evoco expects portfolio acquisitions, assesses potential exits in 2H23

Switzerland-headquartered GP is currently deploying equity via its EUR 162m Evoco TSE III fund

Big Bus tours bidders' interest ahead of September launch of sale process

Sponsor Exponent acquired the UK-based tour company in 2015 via the same-year vintage Exponent Private Equity Partners III

GP Profile: Apheon builds on family roots, mulls exits and reinvestment opportunities

Belgian GP, formerly known as Ergon, to continue to target family- and entrepreneur-owned European businesses

Wise Equity exits Cantiere del Pardo in trade sale

Sale of yachts manufacturer to Calzedonia Group marks second exit from GP’s fifth fund

Princes Group sale restart scheduled for September

Mitsubishi Corporation-owned food and drink manufacturer saw significant PE interest in first round

PAI Partners nears close for EUR 7bn Fund VIII following timeline extension

France-headquartered firm is expected to close the vehicle in November 2023 amid a tough fundraising climate

Equinox pauses Pizzium auction, will reevaluate in coming months

GP acquired the Italian pizza restaurant chain in 2021; the business has overperformed in recent months

Fremman considers return to market in 2024 following newly closed EUR 1bn debut fundraise

Pan-European GP raised its debut fund during the тmost challengingт period for debut funds in recent years

KKA Partners boasts strong US LP showing in latest EUR 230m fund

Small mid-cap investor avoids pure tech businesses and ongoing ‘bubble’

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

CVC raises Europe's largest ever buyout fund, securing EUR 26bn for ninth vehicle

Fund was launched in January 2023 and surpassed its EUR 25bn target, the GP said in a statement

Montefiore expects 100% re-ups for next EUR 1bn-plus fundraise

Past two fundraises saw funds oversubscribed by 3x on consistent exit track record, CEO Eric Bismuth said

It's a new generation: Emerging PE professionals are propelling their careers with ESG – PE Forum Italy

Bridging generational gaps and forging ESG agendas can allow young practitioners to make their mark

Women in PE: Abris Capital Partners' Nachyla on newly launched fundraise and portfolio priorities amid geopolitical challenges

Partner Monika Nachyla outlines the CEE-based GP's fundraising and portfolio development plans

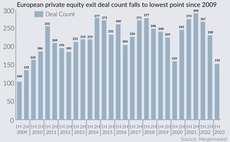

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Federated Hermes raises USD 486m for fifth co-investment fund

Fund surpassed its USD 400m target; its 2018-vintage predecessor raised USD 600m against a USD 350m target

PE purchases stall in Italy as buyers lose faith – PE Forum Italy

PE players are hoping that valuation expectations will align in 2H 2023, easing dealmaking backlog

Seven2 to launch 11th fund in next 18 months as fundraising normalcy nears

Fundraising could pick up by year-end as LP denominator effect continues to wind down

AlphaPet Ventures gears up to collect first-round bids as investors weigh up pet food's appeal

Sponsors including IK and TA Associates expected to look at Capiton-backed German petfood company

Arcven Capital to raise debut VC secondary purchase fund with EUR 80m target

VC aims to provide liquidity to existing startup shareholders, investing EUR 200,00-EUR 2m at discounted valuations