France

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

EU FSR could impact PE fundraising with potential rise in 'clean funds'

FSR could lead GPs to create funds without foreign LPs; red tape around sovereign wealth funds likely

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

IK Investment-backed Eres expected to hit the auction block by 2024

French employee savings distribution and management firm could be valued at a few hundred million euros

Evoco expects portfolio acquisitions, assesses potential exits in 2H23

Switzerland-headquartered GP is currently deploying equity via its EUR 162m Evoco TSE III fund

GP Profile: Apheon builds on family roots, mulls exits and reinvestment opportunities

Belgian GP, formerly known as Ergon, to continue to target family- and entrepreneur-owned European businesses

VC Profile: RTP Global gears up to deploy largest fund to date, remains bullish on breakout opportunities

Partner Gareth Jefferies discusses early-stage deployment plans and advantages of supporting startups throughout their lifecycle

Groupe Vilavi stays French and starts new chapter with HLD

Insurance company is valued at around EUR 300m and will focus on organic and external growth with new majority owner

IPACKCHEM sale attracts Greif, other packaging strategics and sponsors

SK Capital is orking with sellside adviser Goldman Sachs on the process for the French packaging firm

Golding eyes 2024 final close for latest secondaries fund, targets 'undercapitalised' small- and mid-cap space

Asset manager is targeting EUR 500m and is seeing discounts on both GP-led and LP stakes deals

Blackstone takes minority stake in Groupe Premium

Deal values French wealth manager at EUR 1.15bn after earlier full exit attempt saw Eurazeo target EUR 1.5bn

AnaCap in advanced talks for two deals; has 'exciting' financial services and tech pipeline

Financial services-focused sponsor is honing in on one majority and one minority stake deal

Eurazeo co-CEOs seek to reassure market following key departures

Listed GP is also considering options for its stake in Spanish PE platform MCH, it said in its latest results

Siparex kicks off Midcap 4 fund deployment as fund nears EUR 250m target

French glass processing company Cevino Glass marks first investment from EUR 220m fund, which is expected to meet its EUR 250m target by year-end or early 2024

PAI Partners nears close for EUR 7bn Fund VIII following timeline extension

France-headquartered firm is expected to close the vehicle in November 2023 amid a tough fundraising climate

Fremman considers return to market in 2024 following newly closed EUR 1bn debut fundraise

Pan-European GP raised its debut fund during the тmost challengingт period for debut funds in recent years

e-Attestations aims to triple size with new Keensight backing

Keensight is investing in the risk management platform via its EUR 1bn fifth fund, which closed in 2019

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

CVC raises Europe's largest ever buyout fund, securing EUR 26bn for ninth vehicle

Fund was launched in January 2023 and surpassed its EUR 25bn target, the GP said in a statement

Founders Future to kick off EUR 80m-EUR 100m fund this year as 'now is the best time to invest in seed funding'

French VC firm is prepping a new vehicle which will invest EUR 3m-EUR 10m in companies it has already invested in, founder Marc Menasé said.

Montefiore expects 100% re-ups for next EUR 1bn-plus fundraise

Past two fundraises saw funds oversubscribed by 3x on consistent exit track record, CEO Eric Bismuth said

LGT closes fourth global venture capital fund on USD 930m

Primary, co-investment and secondaries vehicle surpassed its USD 750m target

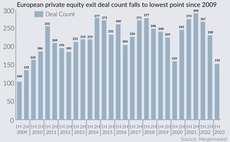

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Capza sees solid demand for Flex Equity strategy as fifth fund reaches two-thirds deployment

GP is seeking bolt-ons for French consulting firm Neo2 following fresh minority investment, partner Fabien Bernez said