Southern Europe

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

EU FSR could impact PE fundraising with potential rise in 'clean funds'

FSR could lead GPs to create funds without foreign LPs; red tape around sovereign wealth funds likely

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

GP Profile: Apheon builds on family roots, mulls exits and reinvestment opportunities

Belgian GP, formerly known as Ergon, to continue to target family- and entrepreneur-owned European businesses

Quadrivio to capitalise on baby boomers as it nears wrap for its new EUR 300m fund

The Silver Economy Fund makes its second investment as it highlights trend of GPs doubling down on narrow strategies

Corus Dental sponsors mandate Houlihan Lokey to review options

Upcoming process for Spain-based dental prosthetics company to launch in September

Triton Partners exploring potential sale of Bormioli Pharma

Italian drug packaging company is likely to draw interest from strategics, plus sponsors with sector experience

Wise Equity exits Cantiere del Pardo in trade sale

Sale of yachts manufacturer to Calzedonia Group marks second exit from GP’s fifth fund

Apax acquires co-controlling stake in Fremman Capital-backed Palex Medical

Deal values Spain-headquartered medical equipment distributor at around EUR 1bn

AnaCap in advanced talks for two deals; has 'exciting' financial services and tech pipeline

Financial services-focused sponsor is honing in on one majority and one minority stake deal

PAI Partners nears close for EUR 7bn Fund VIII following timeline extension

France-headquartered firm is expected to close the vehicle in November 2023 amid a tough fundraising climate

Equinox pauses Pizzium auction, will reevaluate in coming months

GP acquired the Italian pizza restaurant chain in 2021; the business has overperformed in recent months

Fremman considers return to market in 2024 following newly closed EUR 1bn debut fundraise

Pan-European GP raised its debut fund during the тmost challengingт period for debut funds in recent years

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

Pillarstone aims for year-end close for industrials and shipping-focused fund

Italy-headquartered investor typically assists banks with managing underperforming assets

It's a new generation: Emerging PE professionals are propelling their careers with ESG – PE Forum Italy

Bridging generational gaps and forging ESG agendas can allow young practitioners to make their mark

Thematic funds are PEs' secret weapon for times of change, volatility – PE Forum Italy

Betting on secular trebds and corporate partnerships, GPs are finding ways to deploy in a challenging market

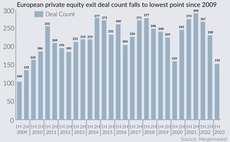

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Capza sees solid demand for Flex Equity strategy as fifth fund reaches two-thirds deployment

GP is seeking bolt-ons for French consulting firm Neo2 following fresh minority investment, partner Fabien Bernez said

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

PE purchases stall in Italy as buyers lose faith – PE Forum Italy

PE players are hoping that valuation expectations will align in 2H 2023, easing dealmaking backlog

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

GP Profile: NB Renaissance outlines acquisition and exit plans in final stretch of current fund deployment

Nearing full deployment for its third fund, Italian private equity firm is prepping one more deal and at least one exit by year-end

AnaCap exits GTT to Stirling Square

Vendor will reinvest in tax collection software for a 20% stake; buyer makes second tech deal in a month