UNQUOTE

Top stories

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

News continued

Analysis

VC Profile: Possible Ventures lines up frontier tech deals halfway through fresh EUR 60m fundraise

Germany-based pre-seed investor is set to hold a first close for its third fund in mid-September

People Moves

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

CapMan Managing Partner Johan Pålsson to depart

PУЅlsson resigns from management effective immediately; to stay as buyout partner until February 2024

Expert Voices

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

Market Insight

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

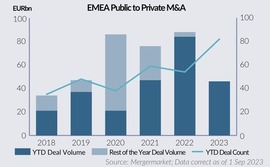

Strategics pull back from PE sales as macro uncertainty bites

Share of trade exits hits lowest point in three years as corporates shore up balance sheets to navigate economic woes

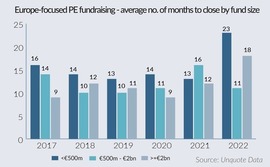

Final close: Sponsors fight through buyout fundraising drought

With EUR 100.5bn in commitments this year, European buyout fundraising is likely to be the lowest since 2018