Analysis/Financing

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve O’Hare about the GP’s approach to its recent realisations

PE purchases stall in Italy as buyers lose faith – PE Forum Italy

PE players are hoping that valuation expectations will align in 2H 2023, easing dealmaking backlog

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

HSBC expects dealflow uptick and higher returns with second direct lending vintage

Second vintage expects to build on USD 580m in current commitments, with first deal expected in July

From slash-and-burn to grow-and-earn: private equity changes tack

Rising cost of capital means value-creation will be vital for next decade of private equity, SuperReturn participants said

European sponsors sidestep panic, concede gloom over bank woes

Fallout from Credit Suisse collapse adds to slew of macroeconomic challenges for PE dealmaking and fundraising

Constructive approach: PEs turn to bolt-ons amid exits and debt crunch

Buy-and-build strategies to take centre stage for sponsors faced with longer holding periods and tough market for platform investments

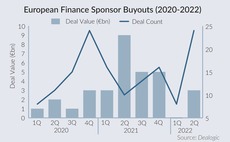

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

Pemberton assesses European market for NAV strategy

Having hired Tom Doyle from 17Capital, the firm is looking at trends including generational change and market consolidation that will drive demand for strategy

GP Profile: 17Capital eyes buoyant NAV financing market

Unquote speaks to managing partner Pierre-Antoine de Selancy about the GP's strategy and market view

Fund financing and ESG: from the impact niche to the mainstream

ESG-linked fund financing facilities are becoming a prominent – and well publicised – tool in the ESG toolbox for GPs and lenders

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

Q&A: 17Capital's Thomas Doyle

"We see no ceiling for the adoption of NAV-based financing as a standard tool for portfolio management"

Sponsor-lender relationship faces stiff Covid-19 test

GPs' relationships with their existing banks and debt funds will remain key to managing the ongoing consequences of the crisis

Video: ThinCats' Ravi Anand

Unquote interviews the managing director of alternative lender ThinCats, a sponsor of the British Private Equity Awards 2020

Video: Travers Smith's Sam Kay on fundraising's paradigm shift

Unquote interviews Sam Kay from Travers Smith, finalist in the Fund Structuring category at the 2020 British Private Equity Awards

BVCA summit: fund financing boom necessitates tailoring

Market participants discuss IRR-enhancing tactics, emergency liquidity and negotiations with LPs

DACH lender sentiment continues to improve – survey

Leverage has not changed significantly for resilient assets, which are still prioritised

Debt funds making inroads in DACH amid Covid-19, says GCA

GCA's Mid Cap Monitor shows that debt funds financed 71% of German LBOs in H1 2020, with the firm expecting an activity uptick in Q4

Q&A: Pemberton's UK head Eric Capp on direct lending's future

Private debt professional Eric Capp discusses his long-term view of the direct lending landscape

UK government extends lifeline to PE assets, but obstacles remain

Clarification for CBILS is deemed helpful, but concerns linger for the Coronavirus Large Business Interruption Loan Scheme (CLBILS)

Unquote Private Equity Podcast: Fund financing in a fix

The Unquote team looks at how PE managers are turning to fund financing in a bid to shore up their portfolios

GPs turn to preferred equity in hunt for emergency liquidity

GPs seek to raise pots of capital fast to insulate their portfolio companies from the economic fallout of Covid-19

PE examines portfolio liquidity options as coronavirus halts dealflow

Managing financial and liquidity risk is front of mind as managers fret over the potential impact of a severe downturn