Investec acquires majority interest in corporate finance firm Capitalmind

Transaction will see the advisory firms fully integrating their M&A and corporate finance teams

Bridgepoint picks Harris Williams for PEI Group exit

Financial intelligence provider could come to market as early as Q4 2023

GP Profile: Limerston Capital anticipates higher volume but more complex M&A as market steadies

UK-based GP is seeing dealflow driven by carve-outs and buy-and-build in a market where organic multiple arbitrage is no longer a given

Mobilab signs deal with Armira in crowded small-cap auction

Founder-owned data applications and infrastructure provider drew sponsor and strategic interest

Archimed closes MED II on EUR 3.5bn

Healthcare-focused GP took 17 months to raise its second mid-cap fund, which has already deployed almost EUR 1bn

Eurazeo-backed DORC catches the eye of dealmakers with H2 process anticipated

Eurazeo acquired the Dutch ophthalmic surgical equipment producer for EUR 430m in 2019

EQT mandates Bank of America for Schuelke sale

GP bought the Germany-based infection prevention firm from France’s Air Liquide in 2020 via EQT VIII

Carlyle acquires Meopta

GP plans to support Czech-American optical products manufacturer’s international expansion

Bugaboo backer Bain strolls back to market for H2 2022 launch

Sale of pram maker was initially launched last year but did not proceed due to credit market and consumer sector concerns

Officine Maccaferri sees Cinven and Triton go head-to-head

Italy-based geotechnical and soil erosion control business could be valued at EUR 700m-EUR 800m

Adams Street secures USD 3.2bn for newest secondaries programme amid LP stakes dealflow uptick

Private markets investor has seen LP stakes increase as a proportion of its deployment over the past year, partner Jeff Akers said

Purple Ventures plans EUR 30m-EUR 40m fund to invest across CEE

Early-stage investor expects to hold a EUR 20m-plus first close for its second fund by Q1 2024

Bewater Funds nears EUR 7m close for second fund, aims to back 20 companies in next four years

Bewater II FCRE takes minority stakes (5%-25%) with tickets of EUR 500,000-EUR 2m, and it has already made three investments.

Unquote Private Equity Podcast: In conversation with... Fabio Ranghino, Ambienta

In an interview with Unquote, Ranghino discusses topics including ESG and the next phase of Ambienta’s growth

Qualium raises more than EUR 500m for third fund against tough fundraising backdrop

French mid-cap GP began marketing the fund in summer 2021; it has deployed EUR 220m to date

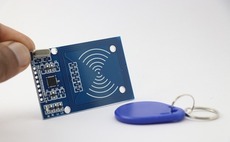

SGT Capital to acquire Summit-backed Elatec for EUR 400m

Mid-market sponsor looks to grow company via “continued technical innovation” and international expansion

Pemberton hires head of Sustainable Investing

Alternative credit lender poaches Niamh Whooley from Goldman Sachs, where she led its fixed income ESG integration team

Egeria to exit GoodLife Foods in SBO to IK Partners

Acquisition of Dutch frozen snack maker marks 13th investment from IK IX Fund

Exponent to return to fundraising trail with fifth buyout vehicle

Fund V comes five years after the GP registered its predecessor vehicle, whose size remains undisclosed

Golding aims to raise EUR 350m for next buyout co-investment fund amid 'unprecedented' dealflow

Vehicle expects to make its first deals this year, providing additional equity for deals against a tough fundraising backdrop

Permira to acquire majority stake in Gruppo Florence

Existing shareholders including VAM Investments and management of the Italian fashion group will reinvest, while Italmobiliare will exit

Mimir Group ramps up global origination effort with London office and focus on life science carve-outs

Stockholm-based investor is considering divestments, although challenging market remains a barrier

Gyrus Capital acquires LRE Medical from KPS-backed AIS Global

Carve-out of German diagnostic equipment manufacturer comes over two years after first sale attempt

The Bolt-Ons Digest - 26 May 2023

Unquoteтs selection of the latest add-ons with H&F's TeamSystem, Nordic Capital's Regnology, 3'i's Dutch Bakery and more