Growth capital deals in UK tech firms reach 10-year high

Investor appetite for growth capital deals in the UK tech market is growing. With funding increasingly available from a variety of alternative backers, is there still room for sustained growth? Kenny Wastell reports

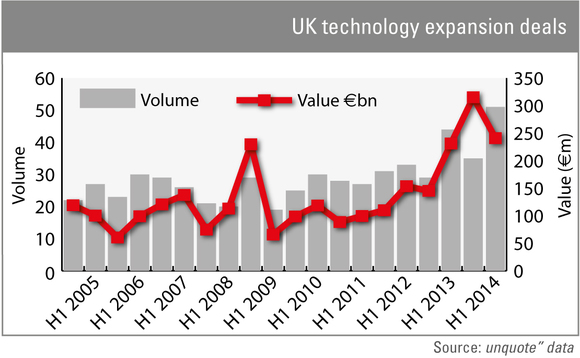

In the past 12 months, expansion deals for UK technology companies have reached a 10-year peak. According to unquote" data, the total volume of deals in H1 2014 was at its highest level since H1 2002, with 50 transactions being completed in all. Meanwhile, at a combined £238m, these deals amounted to the second highest aggregated value across the sample, with H2 2013 seeing the largest total at £315m.

According to a recent report by Silicon Valley Bank (SVB), 51% of UK entrepreneurs said they had successfully raised equity capital in 2013. With emerging concerns about a potential tech bubble in the US, it is reasonable to question whether increased investor appetite could raise similar concerns in the UK.

Fears of a US bubble can be attributed to a slight overheating in public US tech markets, says Mike Turner, head of telecommunications, media and technology at law firm Taylor Wessing. He points to a slight decline in the country's IPO market during Q2, adding that some high-profile consumer tech companies have put flotation plans on hold. "The view on the ground in Silicon Valley is that, aside from IPO markets, the tech market is in fairly rude health," Turner says. "Valuations are considered to be high – not necessarily bubble high – but high." Due to these high valuations, Turner says US investors are increasingly looking to UK tech assets where competition is somewhat lower: "It's actually a sign that valuations on this side of the Atlantic are probably much more reasonable and US investors have recognised that."

For Taylor Wessing, the topic of US investment in the UK is particularly current, given last month's announcement it is to open representative offices in Palo Alto and New York specifically focusing on international markets.

In addition to US venture and private equity firms, Erin Lockwood, managing director of commercial banking for SVB, also points to the increasing number of corporate venture players funding tech growth. Rather than being cause for concern, Lockwood believes increased access to capital is an exciting development that can be widely attributed to the quality of UK assets: "The UK has some amazing technology and talented management teams that have the potential to be global leaders. There's been a lot of great growth and certainly in the last seven years or so, I haven't seen the level of quality in assets that we are seeing right now. While valuations continue to go up, I've seen this largely associated with companies that are experiencing very strong growth and can support such valuations."

Taylor Wessing's Ed Waldron, a partner in the firm's corporate department, reinforces the view that there has been an increased level of expertise, particularly in the London tech industry. Furthermore, Waldron believes the influx of capital for tech companies at the expansion stage is in part due to changing GP strategies: "We're seeing private equity players who are facing strong competition for assets in the mid- and upper mid-market willing to look at earlier-stage tech investing as an opportunity to deploy capital."

Early-stage slump

While venture capital and private equity investment in profit-generating UK tech assets continues to increase, the picture is different when it comes to earlier rounds. According to unquote" data, the £7.1m invested in early-stage rounds (here defined as businesses not yet generating revenues) throughout H2 2013 was the lowest level seen in the last decade. While the £17.8m invested in H1 2014 represented a significant increase, it still falls short of the amounts seen in the same periods in each of the previous three years.

This does not reflect a declining VC and GP appetite for UK start-ups, says Lockwood. Instead, she attributes the trend to an increase in available capital from alternative investors: "There's certainly more capital available at the early stage than I've seen in a while, partly as a result of the growing number of angel investors and accelerators that have been established in London – be they independent or associated with larger corporates."

Indeed, Turner also stresses the increasingly broad market for entrepreneurial capital, with VCs, angels and corporates also competing against investors not traditionally associated with tech. He points to "SEIS and other tax breaks that encourage people to invest money into early-stage tech companies, regardless of the industries in which they made that money".

Neither SVB nor Taylor Wessing expect to see a slowdown in UK tech investments any time soon. "There are lots of investors and corporates sitting on large sums of money," says SVB's Lockwood. "They are looking to deploy that, which presents a real opportunity for UK innovation companies." Similarly, in addition to US investment, Taylor Wessing's Mark Barron, a partner in the corporate technology department, cites the increasing size of UK venture players' funds: "If you look at all of that data, it's hard to see anything other than an increase in the volume of capital being invested."

Star techs

Both Lockwood and Turner highlight the ongoing growth of disruptive fintech businesses, with London now recognised as the industry's global capital, according to Turner. "As a bank, we are obviously extremely interested in the fintech landscape generally and it is an area where London is leading the charge," says Lockwood. Both Turner and Lockwood also agree there is likely to be increasingly sustained investment into software-as-a-service and e-commerce businesses. Other areas where Lockwood expects to see continued growth include social media monitoring companies and wearable technology, while Turner highlights the increasing prominence of adtech and healthtech.

While the value and number of investments in growth-stage tech assets in the UK remain well below those experienced in the dotcom boom of 2000, the market is undoubtedly heating up. The challenge for venture capital and private equity players will be to avoid a similar herd mentality, which saw the spectacular bursting of the 2000 bubble.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater