Regulation could stifle responsible investment, warn industry players

“Private equity is the poster-child of responsible investment,” HarbourVest’s George Anson, chairman of EVCA, said at the association’s Responsible Investment Summit today. But industry participants warned of the damaging impact of over-regulation. Amy King reports from Brussels

"By 2030, the total amount needed for investment in transport, electricity generation and transmission, water and telecommunications is estimated to stand at around $71tn, which amounts to about 3.5% of the GDP of the 34 most developed countries in the world across this same period," said Yves Leterme, deputy secretary general at the OECD and former prime minister of Belgium, speaking at the EVCA Responsible Investment Summit. As public purse strings tighten and European growth stumbles, the need for patient private capital grows stronger by the day.

Indeed, the supply of patient capital provided by institutional investors and intermediated by private equity fund managers, and demand for investment in European infrastructure and businesses are mismatched. "This gap could be reduced if institutional investors – pension funds, insurers and mutual funds – were to increase their role in these markets, and would be in a position to increase their role. In OECD countries alone, these institutions in 2012 held over €80tn, with pension funds collecting around $1tn per year," said Leterme. The private cash is certainly in the coffers, contrary to the barren land of public finances. The question is how to manage it.

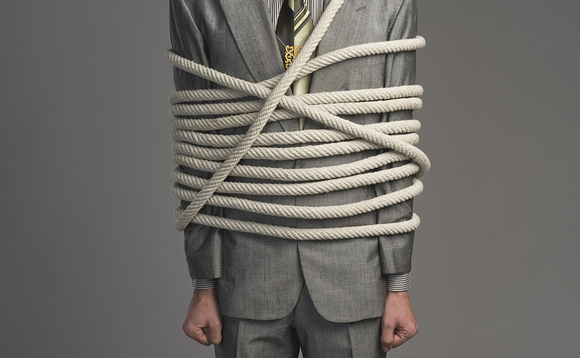

With its long-term goals and structure, private equity seems a natural fit in the shift towards more responsible investment. But with the industry increasingly regulated by supranational bodies, conference participants questioned how likely it would be for the asset class to step up to the mark and fill the gap left by shrinking public finances.

Industry participants warn of the damaging impact of over-regulation

Biting the hand that feeds

"From the perspective of the private equity industry, there is a lot of potential and mechanisms by which private citizens can contribute to long-term asset classes – pension funds and insurers, for example," said EVCA public affairs director Michael Collins. "So the first thing the EU needs to do is avoid breaking those channels of long-term investment. If we get things like Solvency II wrong, then those existing mechanisms will be damaged. Before we get onto creating these new regimes for long-term investment, the primary message would be: don't damage what we already have."

The ever-changing regulatory landscape within which private equity operates represents a great challenge to GPs, whose day-to-day business is impacted by changing rules and increased compliance costs. And with the LP pool shrinking following a global process of deleveraging and de-risking, fundraising has taken a hit. For LPs, which now have to define allocation strategies in a risk-averse environment, the threat of further regulatory changes to locked-up capital is a great deterrent. Said OECD's Karen Wilson: "Policy must remain consistent, otherwise long-term investors will not commit."

The issue of long-term investment has certainly topped the European agenda in recent years. Last year, the European Commission launched a green paper on the long-term financing of the European economy, which resulted in the proposal of European Long-Term Investment Funds (ELTIFs). But with careful regulation and incentivisation, the answer could lie a little closer to home. "In the past we assumed that public money would deliver public goods, but that has changed," said Wilson. "It's not always the public sector that can deliver public goods most effectively. New models of public-partnerships need to be developed."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater