SBOs hit new peak in 2013

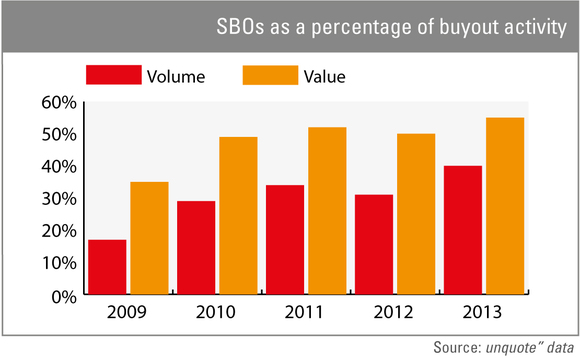

Secondary buyouts rose to new levels of prominence in the European market last year, accounting for 40% of all buyouts and 55% of aggregate buyout value. Greg Gille reports

Is there an end in sight to the rise of "pass-the-parcel" deals? Looking at new proprietary statistics from the unquote" database, SBOs have clearly become an essential component of the European buyout market. Deals sourced from fellow GPs accounted for a whopping 40% of all buyouts in volume, and 55% when looking at their contribution to the overall value of European investments last year.

This is a marked increase on 2012 figures (31% and 50% in volume and value respectively) and in fact the highest percentages ever recorded by unquote". By comparison, the proportion of SBOs averaged at 26% in volume and 37% in value between 2003 and 2007.

Last year's hike wasn't evenly spread across Europe, though. SBOs gained ground in almost all European regions last year – bar in Benelux – but the increases were particularly noticeable in France and the UK as the countries' hectic activity during the boom years keeps fuelling a steady stream of disposals by GPs.

As is traditionally the case, France took the crown with 60% of all buyouts being sourced from other private equity houses, against 40% in the previous year. Notable examples included BC Partners' $1.3bn acquisition of animal tags business Allflex from Electra, as well as the €650m SBO of furniture retailer Maisons du Monde by Bain – both deals were inked in June.

The UK also witnessed secondary transactions creeping up from 26% of all buyouts in 2012 to 36% last year. Vue Entertainment was a standout, with Doughty Hanson selling the cinema group to Omers Private Equity and Alberta Investment Management Corporation for £935m in July.

The prominence of "pass-the-parcel" deals is no longer confined to the upper end of the market either. The contribution of SBOs to lower mid-market dealflow (here defined as deals valued in the €50-250m range) has risen year-on-year since 2009 and broke the 50% barrier for the first time last year, according to unquote" data.

Sentiment in the industry remains divided when it comes to secondary transactions – with GPs understandably keener on emphasising their merits compared to more cautious LPs. That said, most should welcome the positive trend witnessed in 2013: the growing appetite displayed by US private equity houses for European mid-cap portfolio businesses, with UK players, in particular, supplying quality dealflow to their counterparts across the Atlantic (read our analysis on the topic here).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater