Direct secondaries: not just the last resort

The global financial crisis was seen by some as heralding a new, golden age for direct secondaries investors, but deal volumes and values have been declining since 2011. Mikkel Stern-Peltz reports

While there is an impression among some that direct secondaries investors predominantly stick to buying up fund portfolios, some direct secondaries funds include a remit to make minority investments in growth companies, classic buyouts, or atypically structured acquisitions.

Likewise, portfolio purchases are not necessarily limited to private equity and venture capital funds, but may include family offices, banks, corporations and government entities.

“A secondaries strategy is not only funds, and it is not only failing funds,” says Bjarne Lie, managing partner at Nordic direct secondaries specialist Verdane Capital Advisors.

In the same way secondary investors provide liquidity to LPs, direct secondaries investors can provide liquidity to GPs. Furthermore, direct secondaries funds are not necessarily limited to providing liquidity for failing fund managers. They can also play a part in fund rebalancing or restructurings, or in a situation where a GP decides to focus its efforts on a handful of its portfolio companies and wants to free up capital for follow-on investments by selling non-core assets, among other types of transactions.

According to Lie, Verdane tracks more than 1,000 portfolios in its proprietary database and set a firm record last year when it managed 394 outbound deal sourcing meetings in the final three months of the year alone.

“We run more than 1,000 outbound meetings a year,” Lie says. “It is important to bear in mind that only about one third of what we do is traditional funds-structure-deals. For us, it is a broad landscape in which funds are only one part. Other sources of deals include financial institutions, corporates and family-owned portfolios.”

Keep innovating

It is a similar case for UK-based mid-market direct secondaries investor Vision Capital, where the GP's strategy also goes beyond pure portfolio investing. “We are always innovating because people's needs and priorities evolve,” says managing partner Julian Mash.

Vision’s remit has expanded to include classic buyouts in addition to its secondaries strategy, as well as other non-traditional transaction types. It has also raised several sidecars to its main funds in order to provide additional capital to its portfolio companies over the past decade.

Mash says his firm has also been very active in the past year, completing more asset pricings than in any period prior, though he says the firm has completed fewer transactions than usual.

According to Lie, the market for fund portfolios is similar to the market for secondaries – from which direct secondaries got their name – but adds that it is likely a decade behind the secondaries market in terms of how it is viewed and taken into consideration by its main potential clients.

Lie says his firm has been experiencing a new trend, however, where established buyout funds approach Verdane in situations where they are looking for liquidity, suggesting Nordic buyout players are beginning to see direct secondaries as a viable exit option. “Rather than having to sell a portfolio to their next fund, they now call us to see if we can find a good solution,” he says.

As an example, Lie believes firms such as his can offer an attractive alternative to GP-led restructuring. “GP-led restructurings are very popular at the moment. Our view is that it in 90% of the cases it is a flawed model. It is riddled with incentive problems and it is a poor solution to the underlying problem of a fund needing more time and/or capital.”

Post-crisis crisis

Direct secondaries investors were predicted to have their pick of the litter in the post-crisis private equity and venture capital industry as firms scrambled to dump struggling portfolio companies even at low prices. However, after a flurry of activity in 2010 and 2011, deals for private equity and venture portfolios have been increasingly few and far between.

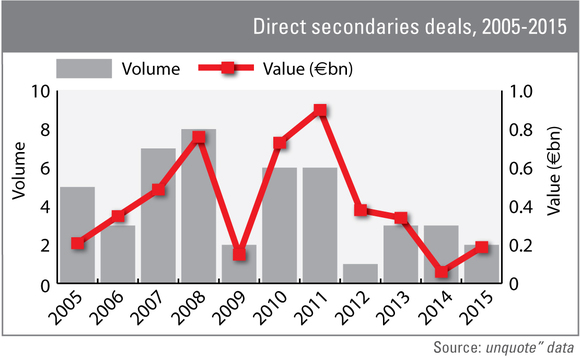

According to unquote” data there were 29 direct secondary deals for private equity portfolios from 2007-2011 totalling nearly €3bn in value. In the three-and-a-half years since, Europe has seen just nine direct secondary transactions worth just less than €1bn (see graph).

The growth in private equity portfolio acquisitions appears to be a clear result of the turmoil caused by the financial crisis, illustrated by the fact that just 14 deals worth a total of €1.3bn had been made in the 10 years prior to 2007.

One man's pain...

Although there was an expectation among investors that opportunities to acquire private equity and venture portfolios would continue at a high level post-crisis, it follows that an investment strategy based on buying troubled portfolios at a discount and selling them high is over-reliant on troubled assets and – by extension – financial turmoil.

According to Mash: “In the immediate wake of the crisis, a lot of predictions were made, like the massive opportunity from deleveraging in the banking system, massive devastation in the GP population – there were all sorts of predictions made at that point and quite a lot of that has sort of happened, rather slowly.

“A lot of predictions about these huge shifts and massive flows have not really happened. They probably will, but at a much slower pace than anybody would have expected in 2009 and 2010."

Mash believes the current market for direct secondaries investors is not much different from the broader private equity sector, where rising valuations and easy credit has put pressure on GPs’ search for value.

His view is shared by Lie: “It is a challenging market at the moment. The cocktail of being in an extended bull-run in the stock market, having a hot M&A market, and significant debt financing available, presents a difficult combination for people trying to buy any kind of asset, and that is no different for a direct secondaries firm.”

Despite declining deal volumes and values in the segment, Mash says there are total mid-cap assets of around $350bn across the US and western Europe, of which 20% are very old and two thirds are old: “Funds that need to be worked through and realised, and that stock of old investments, is much higher than would be expected under normal conditions, because of the crisis. Before anybody declares these things dead, you have to consider the fact that there is this big installed base of investments that are past due.”

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater