Top story

Unquote Private Equity Podcast: Cloudy with a chance of slowdown

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses H1 stats and looks ahead

Unquote Private Equity Podcast: Allocate special

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses all the hot topics from Allocate

Unquote Private Equity Podcast: Generation game

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses new generations working in private equity

First-time challenges in southern Europe

First-time funds may still be facing a tough road in southern Europe, but GPs are getting increasingly skilled at selling a compelling story

Unquote Private Equity Podcast: Sector selectors

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses sector specialisation strategies

LP Profile: LGPS Central Limited

Local government pension schemes partnership recently launched its first PE fund, and is on its way to launching a second this summer

Global LPs boost French mid-market fundraising

Country's macroeconomic outlook has played a vital role in boosting investor confidence in France since 2016

Unquote Private Equity Podcast: Karmic balance sheets

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses recent developments in the impact investment space

Smaller buyouts escalate in UK industrials sector

PE-backed buyout investments in both the industrial engineering and the construction and materials spaces have soared in the past year

CEE venture ecosystem matures as buyout market stalls

With the buyout market at an inflexion point, the local venture capital scene could be the one grabbing headlines in the coming months

Unquote Private Equity Podcast: Ready, debt set, go

Listen to the latest episode of the Unquote Private Equity Podcast, dedicated to the latest developments in the private debt market

Concerning prognoses for German healthcare

Uncertainty around new regulation in the healthcare sector has caused jitters among investors

Bet the farm: reaping the rewards in agri-food investing

Investments in the agri-food tech space have bloomed in the past few years, while an increasing number of new players have entered the sector

European VC catching up to US, says EIF's Grabenwarter

Panellists at the recent Invest Europe Investors' Forum in Geneva extolled the virtues of the European venture ecosystem

Unquote Private Equity Podcast: Sotheby's to PEbay

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses the evolution in the secondary market

LP Profile: Flexstone

Eric Deram talks to Unquote about plans to launch a global fund initiative dedicated to co-investment

Unquote Private Equity Podcast: Training a PE heavyweight

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team looks at what it takes to bulk up a brand ahead of fundraising

Nordic direct lending makes slow but steady progress

Private debt funds have been rapidly expanding their market share in corporate cashflow lending across Europe, but Nordic progress has been slow

LP Profile: Assicurazioni Generali

Group head of private equity investments Sollazzo speaks to Unquote about the insurer’s investment program and plans for 2019

UK private equity anxiety as Brexit crisis intensifies

Twists and turns in the Brexit process are making it increasingly difficult for private equity practitioners to prepare for what lies ahead

Bifurcation in European fundraising: beat the traffic

Recent years have seen the growing polarisation of fundraising fortunes for GPs, with established managers able to raise faster than their peers

GP Profile: Alantra Private Equity

Spain-based mid-market player has completed six deals in the past 12 months and is focusing on expanding and managing its current portfolio

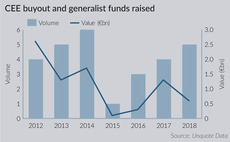

CEE fundraising activity promises buyout revival

Fundraising in the region held strong in 2018 in contrast to the rest of Europe and promises to be even stronger in 2019, even as dealflow slumped

Benelux trade deals surged in 2018

Exits to strategic buyers accounted for 56% of all divestments, with the volume of such deals increasing by 68% year-on-year