Deal in Focus: Track record paramount in Altor’s Infotheek deal

Altor’s acquisition of IT equipment refurbishing business Infotheek, marking the GPs second ever deal in the Netherlands, highlights the importance of sector success when it comes to winning processes. Alice Murray reports

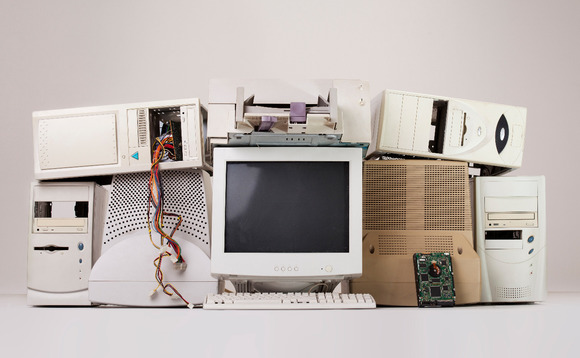

In early April, Altor finalised its purchase of a majority stake in Dutch business Infotheek, which offers new, end-of-life, renewed and refurbished IT hardware to businesses.

According to Altor partner Stefan Linder, the GP was introduced to the company by Infotheek's adviser. "I assume they felt Altor was a suitable candidate because of our previous experience as active owners of Dustin, and the long-term development of that company in partnership with entrepreneurs and management."

Indeed, Altor acquired an 80% stake in Stockholm-based Dustin in August 2006. The business has similarities with Infotheek in that it predominantly focuses on the business-to-business market, providing IT products and services. The company is also engaged in refurbishing IT equipment. Altor listed Dustin on the Stockholm Stock Exchange in February 2015, which valued the company at SEK 3.8bn.

During the deal talks, while Altor's strength in the IT reselling market had been proven, the main question was over the GP's ability to engage outside the Nordic countries. "However, we felt comfortable with the domain that Infotheek operates in, albeit distinctly different in terms of geography and offering compared with Dustin, and found the growth opportunities attractive," explains Linder.

And while the majority of Altor's deals have taken place within the Nordic countries, this deal is not its first outside the region, with its acquisition of a majority stake in French ski equipment business Rossignol Group signed in July 2013. Again, the GP was able to win this deal because of its success with Oslo-based Helly Hansen, a retailer of clothes and accessories focused mainly on the skiing, sailing and outdoor activities markets. The deal awarded Altor with a 6x return when it was sold to Ontario Teachers' Pension Plan in July 2012.

Long-distance relationship

According to Linder, in order to deal with the lack of proximity between GP and company, the Altor team will spend substantial time in the Netherlands working with the management team. "We will work together in two ways. First is the more formal route via Altor being represented on the board of directors. Second, we will have more frequent informal interaction, when we need to discuss, for example, operational improvement opportunities and acquisitions. We will spend a lot of time and resources supporting the company; fortunately there are good links between Stockholm and Amsterdam."

We will spend a lot of time and resources supporting the company; fortunately there are good links between Stockholm and Amsterdam" – Stefan Linder, Altor

Altor was attracted to Infotheek because of its owner-manager structure. Says Linder: "We have good experiences of partnering with owner-managers, which in this case are very strong and very committed."

Following the deal, Altor will support the company's growth both organically and acquisitively. "We feel Infotheek is a strong enough platform to build a pan-European leader. The market is very fragmented and there are lots of smaller local players," says Linder.

In terms of exiting Infotheek, the plan for the time being is to keep as many options open as possible. "Exit is not our core focus right now, we have a long-term outlook for the company. With that said, the vision is always to build attractive, high-quality companies both in terms of market position and internal processes, as well as from an external investor perspective. There could be an exit opportunity in a larger global consolidation but given the company's growth and future expansion plans it should make an attractive candidate for a listing as well," says Linder.

People

Altor – Stefan Linder (partner).

Infotheek – Jordy Kool (CEO).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater