Early-stage

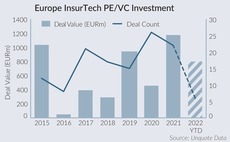

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

World Fund leads EUR 128m raise for quantum computing group IQM

Series-A2 for Finnish startup focused on combating the climate crisis also backed by the EIB

Gorillas raises circa USD 1bn in Delivery Hero-led Series C

New funding comes just seven months after a Series B, with the company doubling in value

French mega-rounds shoot up in 2021

France has already seen as many rounds of EUR 100m and above than in 2019 and 2020 combined, Unquote Data shows

L Catterton et al. in EUR 100m round for SellerX

SellerX has already raised amost EUR 250m in debt and equity in its 12 months since inception

Mega-rounds fuel record H1 for venture and growth

Largest rounds inked in the first six months of 2021 read like a veritable Who's Who of European fintech heavyweights

Point72 Ventures leads €20m round for Curb

Food startup was founded in 2020 and will use the funding to invest in technology and its expansion in Stockholm

EQT Ventures backs Lenus with €50m series-A funding

Round is the largest series-A round ever secured by a startup in Denmark, according to EQT Ventures

Novo Seeds, Ysios Capital lead €51m round for Adcendo

RA Capital Management, HealthCap and Gilde Healthcare also take part in the round for the biotech startup

Jolt, Tesi et. al in €30m round for Virta

With the funding, the Finnish company will seek to expand into Asia, which it said was one of the largest markets for EV charging alongside Europe and North America

Gyroscope Therapeutics raises $148m in Forbion-led series C

Series-C round for the gene therapy company is led by Forbionтs Growth Opportunities Fund

OpenOcean and Spintop lead €3.6m series-A for Cambri

Lynda Clarizio, former president of Nielsen US Media, joins the board of directors

ByFounders leads $4.6m seed round for Proper

Other investors include PreSeed Ventures, Prehype, Vaekstfonden and Bjarke Ingels

Claris Ventures leads £15.2m series-B for NeoPhore

2Invest, 3B Future Health Fund, Astellas Venture Management and CRT Pioneer Fund also take part in the round

DCVC Bio leads $17m series-A round for BioPhero

Startup will use the funding to start production of its first product and make it available worldwide

Global PayTech Ventures invests €4m in Subaio

Deal is Global PayTech’s first investment and will help Subaio expand into new European markets

Hiro Capital invests $15m in three gaming studios

Funding will help the studios expand their development pipelines and accelerate global growth

Left Lane Capital leads €8.2m series A for Memmo.me

Swedish platform allows users to request personalised video messages from celebrities

Midroc New Technology leads €9m round for CorPower Ocean

Wave energy startup has so far raised тЌ38m in equity and public investments

Blue Horizon leads $10m extended series-B for Mosa Meat

New round brings the total capital raised at series-B stage to $85m

Industrifonden leads €4.6m extended series-A for EnginZyme

Latest round brings company's total series-A funding to тЌ11m

Braavos leads SpyBiotech's $32.5m series-A

Proceeds will advance the clinical development of SpyBiotech's vaccine technology platform

EQT Ventures leads €75m series-B round for Instabox

Funding will be used to develop technology to enhance value-chain for customers and merchants, and for expansion outside of Sweden

Oaktree invests £200m in RedCat

It is expected that the company will raise an additional ТЃ300m in debt, according to the Daily Telegraph