Baltic buyouts boom as CEE slumps

The Baltic region bucked the trend of decreasing private equity dealflow seen in the rest of the central and eastern Europe region in the first nine months of 2018. Oscar Geen reports

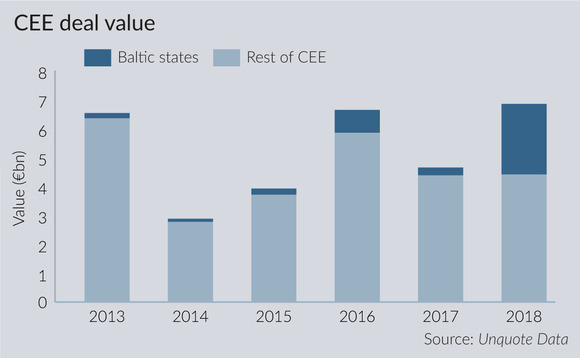

Private equity firms in CEE as a whole had a tough time in the first nine months of 2018. The region recorded a bigger decrease in buyout volume than any other European region, with just 29 deals completed, compared with 42 in the same period for 2017. Value increased by 81%, but this is largely explained by two large-cap deals that were cumulatively valued at almost €4bn.

Abris Capital's Edgar Kolesnik is not convinced these statistics are representative of the part of the market he invests in, and thinks they could be distorted by a limited number of situations: "There is a limited number of major transactions in the CEE region. These deals get a lot of interest from international private equity funds and strategic players, driving high prices and becoming big M&A processes. That is why we seek proprietary investments in the mid-market segment."

Abris itself has had a very active year, completing four buyouts of Polish companies. Kolesnik explains how their approach facilitates this. "We have quite a consistent dealflow because we focus on mid-sized enterprises with clear growth potential," he says. "There is a good supply of such companies and we tend to focus on family succession transactions."

However, Kolesnik acknowledges that pricing issues have led to some processes not completing: "If there has been a slowdown in the mid-market, it is probably related to pricing expectations. Business owners see the multiples achieved in larger transactions and expect them to be applicable in the mid-market." This is a phenomenon Unquote has heard reported by market participants across Europe, especially in northern Europe, where multiples for tech deals have been extremely high and widely reported.

Baltic boom

By contrast, the Baltic states have seen a steady growth in dealflow as the number of private equity investments for the year to date increased to 14, versus eight last year and 12 in 2016. The buyout of Luminor by Blackstone, with a €1bn equity ticket, made up a large chunk of value, but it was the only large-cap deal to complete in the period.

Baltcap Management focuses purely on the Baltic states and has completed two deals and seven exits this year. Managing partner Martin Kõdar says: "It has been very active and a lot of deals have been done. There are a lot more managers that have emerged and everybody is looking at the Baltic countries because the economy continues to be strong."

Kõdar explains that, although this international interest is creating good exit routes, it is not creating too much competition for local funds, which tend to target smaller deals. "The majority of companies that we target for our funds are below the radar of large international players," he says. "Most of these are not really prepared by advisers, so you have to source and develop these deals yourself."

We have a consistent dealflow because we focus on mid-sized enterprises with clear growth potential. There is a good supply of such companies" – Edgar Kolesnik, Abris Capital

Estonia produced its fourth unicorn this year when Korelya Capital took part in a $175m funding round for ride-sharing app Taxify at a valuation north of $1bn. Prior to this round, Taxify had only raised $1.75m of external capital from Latvia-based Rubylight and TMT Investments, underlining Kõdar's point that the local funds are more likely to benefit from international attention than suffer from the competition.

However, it is not just technology companies that are attracting interest. "There have been many more deals done in the traditional sectors than in technology," says Kõdar. "We have made seven exits this year and a majority of them have been sold to foreign strategic buyers. The region is on the radar of strategic investors, so we have proven during the past two years that you can successfully exit your investments if you have good companies in the portfolio. That has been a question for LPs, but in the past year we have been able to show that."

Recent track records aside, Abris's Kolesnik is confident in the ability of CEE-based firms to overcome any short-term difficulties and succeed in the future: "Generally, private equity houses are quite resilient businesses that adapt to new circumstances. Every year or every couple of years, players adapt to how the market looks and how they can do deals that create value for all parties. This is why it is important to focus not just on the number of deals but the quality of the deals as well."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds