Shot in the arm for DACH healthcare market

Market consolidation opportunities in the DACH mid-market have fueled an uptick in investment activity from private equity players. Oscar Geen reports

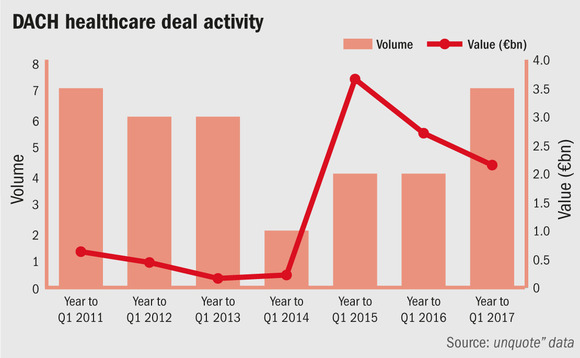

The volume of healthcare provider deals in the DACH region was at its highest since 2011 in the 12 months leading up to March 2017, according to unquote" data. Last year also ended on a high, with the best quarter since 1992 with the sub-sector recording four buyouts in Q4 2016.

This is partly due to consolidation – because the market is fragmented, the most effective strategies are platform acquisitions with buy-and-build opportunities, logically driving up dealflow.

Martin Brunninger of Goetzpartners tells unquote" that this has already been seen in the acute market and is starting to take hold in the rehab market as well. "Rehab is a fragmented market in Germany and offers earnings growth through consolidation and subsequent pricing power with insurance groups," he says, referring to the recent acquisition of Orthoparc as part of the expansion by Waterland's Medienklink spinout Atos. "Waterland is leading the German rehab consolidation trend, but there are other players. While margins are lower and reimbursement rates are more fluid, the fragmented market leaves opportunities for the consolidators."

Our belief is that in both rehab and acute sectors there are interesting opportunities in the market. There are many mid-sized targets that we are trying to approach" – Carsten Rahlfs, Waterland Private Equity

Waterland is looking at healthcare in the DACH region as a safe haven. Partner Carsten Rahlfs says that when there are potential economic and political crises looming, people look to less cyclical segments, including healthcare. Germany is seen as very stable in that space, and within that the fragmented service provider market presents opportunities. "Our belief is that in both rehab and acute sectors there are interesting opportunities in the market," says Rahlfs, adding that Waterland tries to avoid big auctions and sources its own targets. "There are many mid-sized targets that we are trying to approach."

Daniel Huber, principal at Boston Consulting Group, says private equity firms are now finding value in this market that was previously considered too complex: "Now that good opportunities are harder to source, private equity companies have a higher tolerance for complexity." Managing director Michael Thorwarth explains how some firms are currently using elements of the consolidation model already observed in the laboratory space and applying it to the healthcare services sector. The acquisition and merger of two radiology clinics by Deutsche Beteiligungs AG as the beginning of a buy-and-build strategy was one example of this in the last quarter.

Small issues

The healthcare services sub-sector has been less active at the smaller end of the market, however. This is partly because many VC houses and private investors are focused on technology-driven companies, and the sector has been slow to adapt to digitalisation trends, according to market participants. But that trend is beginning to change. Caroline Fichtner, investment director at Germany's most active VC High-Tech Gründerfonds (HTGF), tells unquote" that the company does not discriminate based on sub-sector. "We do not exclude any area; if the company is asking for funding in an innovative technology product or service we will look at that."

Sophie Chung, a medical doctor and founder of Project A-backed Junomedical, says that the market is starting to see funding for consumer healthcare companies that use technologies to better inform patients. This has yet to be picked up by the larger players but Chung thinks this needs to come from the bottom up: "Companies such as Junomedical are pushing into the market to show a different way of consumer participation, trying to empower the patient and make things more transparent. This makes large traditional players nervous."

Goetzpartners' Brunninger agrees that the healthcare services sector has been slow to adapt to digitalisation trends: "Healthcare is not consumer driven, and will be transformed more slowly. It would make sense technically, but it is very difficult given the complexity of stakeholders and the absence of standards." One trend that Brunninger can see coming to Germany is a payment model erring towards capitation, which has been implemented in the US with the Affordable Care Act. The risk is passed directly to the provider rather than via the traditional fee-for-service model. This means the providers take on more risk but are able to gain by managing the insured more effectively. As a consequence, both policy makers and providers would drive the electronic health record and invest more in areas like digitalisation and potentially drive clinical benefits and improve outcomes.

One thing all market participants agree on is the importance of public-private collaboration in this sector. Although the sentiment is there, from the government's side the execution is sometimes lacking – Chung believes the traditional VC model with government funding is a lot more effective than programmes that offer forgivable loans or similar incentives. "The process can be incredibly complicated, it can feel like you are applying for a scientific grant rather than getting soft funding. However, IBB and HTGF are great examples of how it can work."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds