Germany

VC Profile: Possible Ventures lines up frontier tech deals halfway through fresh EUR 60m fundraise

Germany-based pre-seed investor is set to hold a first close for its third fund in mid-September

Felss Group backer Capvis lines up PwC to guide sale process

Sale of German cold-forming specalist is under way, six and a half years into GP's holding period

Dataciders sponsor Auctus mulls sale via Houlihan Lokey

German GP first acquired the local IT services group in May 2019 via Auctus V, a 2019-vintage

VC Profile: RTP Global gears up to deploy largest fund to date, remains bullish on breakout opportunities

Partner Gareth Jefferies discusses early-stage deployment plans and advantages of supporting startups throughout their lifecycle

Golding adds insurance expertise with hire for institutional clients team

Tim Ickenroth joins as director with prior experience at BNP Paribas and UniCredit

Synlab remains in talks with Cinven five months after initial approach

Cinven listed lab diagnostics firm in April 2021 at EUR 18 per share and remains its largest shareholder

EQT exits Schuelke to Athos-led consortium

The Munich-based family office has been an LP in EQT's funds; joined recent co-investment tickets

Teasers out for Ardian-backed imes-icore

No formal process has kicked off for the German medtech firm but significant sponsor interest is expected

Hg Munich partner departs after 10 years with sponsor

Stefan Margolis was promoted to partner in 2020 and led the GP's acquisition of Serrela

Active Capital in EUR 150m fundraise; SIF strategy and portfolio companies eye buys

Industrials-focused sponsor expects reshoring trend to generate uptick in opportunities

Fremman considers return to market in 2024 following newly closed EUR 1bn debut fundraise

Pan-European GP raised its debut fund during the тmost challengingт period for debut funds in recent years

KKA Partners boasts strong US LP showing in latest EUR 230m fund

Small mid-cap investor avoids pure tech businesses and ongoing ‘bubble’

Netzkontor sponsor DBAG weighs exit options following beauty pageant

GP acquired the German telecoms service provider in 2018 and has subsequently made 13 add-ons

AlphaPet Ventures gears up to collect first-round bids as investors weigh up pet food's appeal

Sponsors including IK and TA Associates expected to look at Capiton-backed German petfood company

SGT Capital focuses on co-investments and LP diversification in next stretch of USD 2bn fundraise

Co-managing partner and former Mormon missionary turned financier Joseph Pacini speaks to Unquote as the firm’s current fund nears a USD 1bn-plus second close

TSG's Bergfreunde hits the market in JPMorgan-led auction

Sale of German online clothing retailer follows performance spike during COVID-19 pandemic

Unquote Private Equity Podcast: PE perspectives from Berlin

Unquoteтs Min Ho and Rachel Lewis digest the key takeaways from this yearтs SupeReturn

MPEP launches fifth buyout fund-of-funds with EUR 300m target

Lower mid-market specialist will continue to apply thorough due diligence for new and existing relationships, seeking persistency of returns

Main Capital exits Cleversoft to LLCP

Nordic Capital and OTPP's Mitratech were also in the running to buy the regtech platform, Mergermarket reported

From slash-and-burn to grow-and-earn: private equity changes tack

Rising cost of capital means value-creation will be vital for next decade of private equity, SuperReturn participants said

Investec acquires majority interest in corporate finance firm Capitalmind

Transaction will see the advisory firms fully integrating their M&A and corporate finance teams

EQT mandates Bank of America for Schuelke sale

GP bought the Germany-based infection prevention firm from France’s Air Liquide in 2020 via EQT VIII

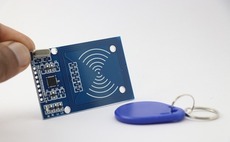

SGT Capital to acquire Summit-backed Elatec for EUR 400m

Mid-market sponsor looks to grow company via “continued technical innovation” and international expansion

Golding aims to raise EUR 350m for next buyout co-investment fund amid 'unprecedented' dealflow

Vehicle expects to make its first deals this year, providing additional equity for deals against a tough fundraising backdrop