Deal in focus: Astorg Partners buys Megadyne

Having spent four years seeking its first transaction in Italy, the hard work paid off for Astorg Partners last week when the GP inked a deal to take a majority stake in belts and pulleys manufacturer Megadyne. Amy King reports

Last month, Astorg Partners announced its first investment in Italy in a deal that marked the second exit – albeit partial – of Italy's most active GP, state-supported investor Fondo Italiano di Investimento. Investing via Astorg V, a €1.05bn vehicle that closed in 2011, the buyer took a majority stake in belts and pulleys manufacturer Megadyne from Fondo Italiano, the Tadolini family and senior management in a transaction valued north of €400m. The former shareholders reinvested to retain a minority stake in the asset.

"This is the result of four years of effort, with a number of our team going to Italy on a very regular basis to look at deals," says François de Mitry, partner at Astorg, which focuses mainly on B2B companies in manufacturing and services. "There are quite a few deals at the smaller end of the market, but when you get to deals above a certain size, there are very few transactions. You need all the stars aligned to do a deal in Italy – you just need to be patient." De Mitry began his career in Italy 25 years ago.

In August 2012, Fondo Italiano committed €20m to Megadyne in exchange for a minority stake. The company had been on Astorg's target list for several years, but deal discussions only began at the start of 2014. The transaction, which is expected to have a short closing time, involved a debt package provided by four international banks with a local presence: Intesa Sanpaolo, BNP Paribas, Crédit Agricole and Natixis. Comprising an A and B structure, the debt package is equal to around 4x EBITDA.

Fondo Italiano reinvests to retain a stake alongside Astorg Partners

IPO dreams

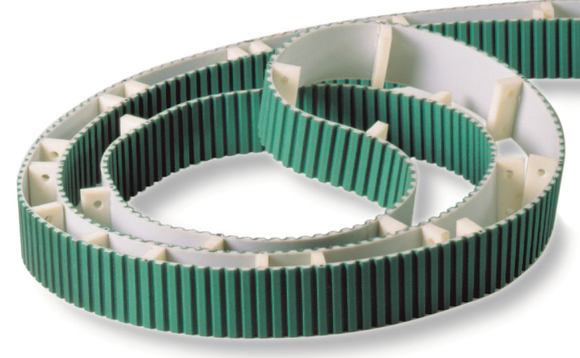

Founded in 1957 and based in Mathi, Megadyne produces polyurethane and rubber belts, pulleys and complementary products for a range of industrial sectors. The company employs 1,600 staff worldwide, across 10 manufacturing sites and 33 commercial branches in Europe, Asia and America. "This business is growing well in a growing industry – it's also really active in Asia. We want to accelerate growth by external acquisitions. In the end, the aim is to reach such a size that we can list the company," says de Mitry.

After a recession that span six years finally drew to a close at the end of 2013, this year has proved challenging in Italian private equity. Compared to neighbouring Spain, where international and local players alike are set to deploy freshly raised capital on the back of an industry renaissance, the Italian private equity market is noticeably quieter. However, this may soon change; according to a source involved in the transaction, the Megadyne deal was the most fiercely competed auction for some time, with several larger buyout houses bidding for the asset. The deal suggests GPs are ready to put money on the table for the larger assets, however few and far between they may be.

People

Astorg Partners – Francois de Mitry, Lorenzo Zamboni, Nicolas Marien, Benjamin Dierickx, Jacques-Henry Grislain.

Fondo Italiano di Investimento – Lorenzo Baraldi, Stefano Tatarella and Francesca Elia worked on the deal for .

Advisers

Company – Rothschild, Irving Bellotti, Riccardo Rossi (Corporate finance); NCTM, Pietro Zanoni, Pietro Rossi Cairo (Legal); KPMG, Massimiliano Di Monaco (Corporate finance).

Equity – Leonardo & Co, Andre Pichler, Cristiano Cirulli (Corporate finance); Bonelli Erede Pappalardo, Mario Roli, Calogero Porrello (Legal); EY, Umberto Nobile, Pasqualina Cosentino, Roberto Lazzarone, Mauro Scognavilla (Financial due diligence); LEK Consulting, Serge Hovsepian, Frédéric Dessertine, Maxime Julian (Commercial due diligence).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater