Italy: Nowhere to hide for buyout model after average returns

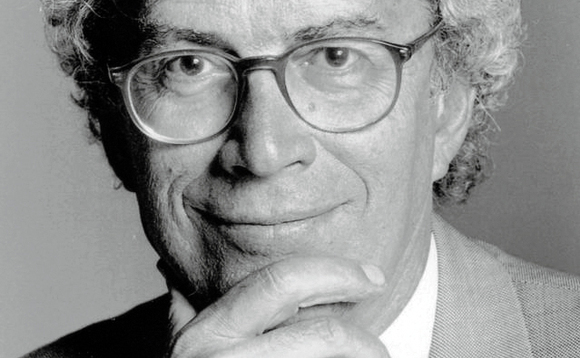

Private equity veteran Gianfilippo Cuneo (pictured) opened fire on buyout houses last month, accusing GPs of hiding behind recent statistics that show an uptick in Italian dealflow. Amy King reports

Writing in Corriere Economia, the founding principal of Investitori Associati and current chairman of Synergo suggested that private equity players, particularly those in the buyout space, are trying to divert investors' attentions away from falling returns, which no longer justify continued commitments to the sector.

"I disagree with those who use 15 years of statistics about buyout returns, calculate averages for the period and conclude that buyout is a good asset class; in the first half of the period returns are good, but in the second period they are very low," Cuneo told unquote". "One would not use a 15-year average of Federer's performance to conclude that he will be winning in the next 10 years as well."

Citing a study carried out by Cambridge Associates of 590 global buyout funds, Cuneo wrote that average returns from 2004-11 stood at 8%. On the other hand, investing in S&P 500 companies over the same period would have yielded returns of 12.5%. Given that private equity funds leave LPs' capital in long-term lockdown, one may question the buyout space's continued attractiveness to investors.

"I followed a successful buyout model until 2004, when I felt the model had become too mechanical, too inflated, too leveraged, too optimistic... When you have success for 10 years, you can become optimistic about everything. I felt that the growth model was safer, as you are putting money into the company and not giving it to the seller. And there is lower leverage, as you are focusing on growth," he says. But is the industry professional right to criticise buyout returns?

Aifi president Innocenzo Cipolletta thinks not. He wrote his retort in the same publication, highlighting statistics published by KPMG that show the average IRR of global buyout funds at 18.9% in 2013. He also suggested that extrapolating the data provided in Cambridge Associates' study to include 2013 statistics would see average IRR rise to 14.6% in the buyout space.

Sinking feeling

Italy has, of course, been home to several home runs since 2011 - the final year in the data sample cited by Cuneo. Noteworthy exits of late saw Moncler, backed by Carlyle, Progressio Investimenti and Eurazeo, return cash to GPs' coffers via the public market, trading up 40% on the pre-opening price on the first day. The sale vindicated the earlier decision to pull the IPO in 2011, as the recent flotation took home the title of Europe's strongest market debut. In the fashion sector once again, Permira enjoyed a money multiple of around 33x on the sale of Valentino to Qatari investors after a long turnaround of the company in 2012, the same year that Moleskine became a jewel in Italy's crown following its flotation.

However, according to unquote" data, stellar returns have tailed off in recent years in the bel paese – perhaps not surprising given the country's rocky economic past. A report released by KPMG with the ominous title Under a Cloudy Sky also revealed falling IRRs in Italy in 2012 due to 34 write-offs, with an average money multiple standing at just 1.3x. Indeed, the study suggests that even top-quartile performers saw returns fall by 4% in 2012 to 20.1%.

"It is a major mistake not to understand that the world has changed since 2008," says Cuneo. "That doesn't mean that some buyout funds don't have very good returns – there is always a lucky one. But, statistically, they are not significant. On average, it is not a very good business proposition anymore."

Is it then time for Italy to move away from the buyout model, which has accounted for 53% of deal volume over the past decade? Minority investments certainly seem to be gaining momentum in Italy, with Blackstone's recent purchase of a 20% stake in Versace a notable shift away from controlling stakes and towards shared ownership. Historically, private equity buyouts have accounted for 70% of overall activity in the fashion segment, though that figure is decreasing. Perhaps Italian GPs can be tempted away from the majority ownership model for the right asset and the promise of much-needed high returns.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds