Can private equity save the high street?

Recent months have seen carnage on the high street as numerous retailers failed to survive the critical Christmas period, with a string of administrations hitting the industry. With consumer spending constrained by difficult economic conditions and internet-focused firms rapidly increasing their market share, is there any hope for investing in bricks & mortar retailers?

January saw both HMV and Blockbuster in the UK fall into administration, following hot on the heels of similar problems at camera specialist Jessops, electricals retailer Comet and the French Virgin Megastore chain. In the UK alone, almost 200 retailers went into administration in 2012, including 50 larger entities, according to research by Deloitte. With numerous firms struggling over the critical Christmas period, 2013 is already shaping up to be another bad year for the sector.

Private equity funds have been burned by poorly performing retailers in their portfolios, though this has primarily been a problem for turnaround investors who expect higher failure rates. OpCapita had backed Comet back in late 2011 when it was already struggling to pay suppliers. However, the combination of cut credit lines and lower consumer demand for the kind of big ticket electrical goods it sold means the business simply couldn't continue and quickly closed in the run up to Christmas. OpCapita also owns Game Group, the video games retailer that went into administration early last year after the firm struggled to keep up with competition from supermarkets, online retailers and the growing popularity of digital distribution.

HMV, Virgin Megastore and Blockbuster faced similar problems to Game. As physical media has become increasingly sidelined in favour of digital downloads, the firms failed to keep up, and Blockbuster was slow to move into the DVD postal rental market currently dominated by firms like LoveFilm and also missed the boat on the rapidly growing digital streaming market.

Numerous retailers failed to survive the Christmas period. Is there hope for investors?

Perhaps these businesses could simply be seen as dinosaurs of a bygone age that failed to anticipate consumer trends and have now been usurped by younger firms with more modern business models, rather than purely being victims of economic circumstance.

HMV itself has been backed by restructuring specialist Hilco, which bought the company's debt and reached agreement with major music and film publishers to obtain better credit for the company. However, it seems likely many stores will have to close and the move could simply prolong the inevitable decline of this kind of retailer.

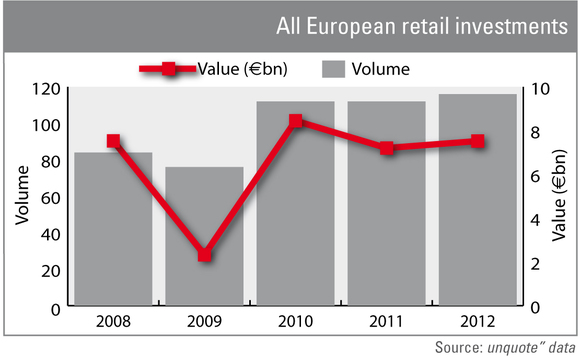

Despite the apparent vulnerability of the non-food and drugs retail sector, private equity investments in retailers have held up remarkably well. As the above chart shows, retail investment remains strong, with more than 100 deals in each of the past three years across Europe. Of course, online-focused retailers (see chart below) make up a significant chunk of these investments, but are by no means in the majority.

It's worth remembering that it hasn't all been bad news on the high street this Christmas. Some retailers have performed well, like John Lewis, which once again saw a rise in sales, while Dixons Group, which owns the Currys PC World chain, posted strong results on the back of growing demand for tablets and reduced competition for big electricals sales following the demise of rival Comet. Additonally, Argos also reported strong Christmas trading, saying its strategy of allowing customers to browse and order online and then collect their goods in store proved popular.

Investing in retail isn't a recipe for failure, but it is an industry undergoing huge changes and needs to adapt to meet the new needs of consumers. This perhaps makes private equity well placed to invest in retailers, offering the possibility of reforming their business models to take advantage of what both the internet and physical stores can offer to consumers, maximising the benefit of both.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater