Exit market hits €15bn in December

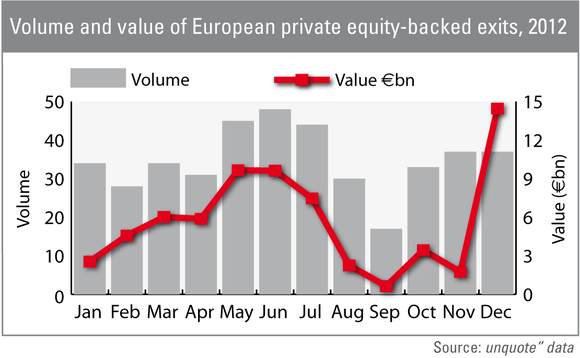

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

The total value of exits in December last year hit €14.45bn, significantly higher than the previous high for the year of €9.65bn seen in May.

The volume of exits recorded by unquote" in December hit 37, level with November, but up significantly from the 17 disposals seen in September. However, the summer period saw a great volume of exits, with 45 sales in May, 48 in June and 44 realisations in July.

A series of hefty exits in December helped push the total value of realisations upwards, starting with the €1.32bn sale of SBS Broadcasting by KKR and Permira. The buyout firm bought the Nordic broadcaster as part of the €3.3bn ProSiebenSat.1 acquisition in July 2007, relocating its headquarters to Luxembourg. Trade buyer Discovery Communications acquired the business.

The largest exit was the €3.3bn sale of aerospace manufacturer Avio to General Electric. Previous owner Cinven acquired the Italian business in 2006 in conjunction with Finmeccanica, an Italian defence group.

Trade sales were by far the most popular exit route in the final month of 2012, with 17 portfolio companies sold to corporates. Secondary buyouts followed close behind, with 11 investments sold onto other financial buyers in December.

Looking at 2012 as a whole, trade sales were again dominant, with 179 exits. The trend clearly shows the important role corporates are playing in the private equity ecosystem today, with many thought to be cash-rich, following years of hoarding in the wake of the financial crisis. Many large trade players are now looking for potential bolt-ons to help them grow.

The much maligned secondary buyout is the second most popular exit route, with 114 in 2012, broadly consistent with past trends.

However, the IPO market is in a dire state, with just seven flotations last year – indicative of the ongoing uncertainty in global markets. Interestingly, the decline of the IPO has been countered by a boom in partial exit activity, with 51 partial sales in 2012. For some GPs that are unable to list their larger portfolio companies, a partial sale to a major trade player has become a popular option. KKR's sale of a stake in Alliance Boots to US-based trade player Walgreens is one such example.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater