IPO activity dwarfs 2012 after first quarter

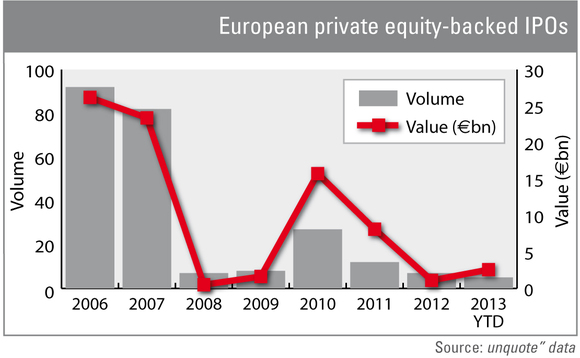

Private equity-backed IPOs are making a major comeback and could be set to reach their highest level since 2010, according to figures from unquote” data.

As the first quarter of 2013 draws to a close, a glut of private equity-backed flotations has increased optimism over the ability of funds to successfully exit their portfolio companies onto the public markets.

Figures from unquote" data show there have been five IPOs so far in 2013, just slightly less than the seven seen in the whole of 2012. If current momentum is maintained, 2013 could see IPO numbers exceed 2011's 12 listings, and even approach the 27 private equity-backed flotations seen in 2010.

Furthermore, the value of flotations has already exceeded 2012's poor showing. Total market cap of European private equity-backed businesses listed in the first quarter of 2013 reached €2.9bn, up 163% compared to €1.1bn for the whole of last year.

While the figure is still some way short of the €8.1bn seen in the whole of 2011, first quarter performance could bolster the confidence of some businesses that have been looking to exit for some months. CVC company Evonik is widely expected to list in the coming months, after the business placed shares with institutional investors, a move CVC also used prior to listing its Formula One Group portfolio company last year.

If Evonik does list, it would be the largest European listing since the financial crisis, as the recent share placement values the German chemicals specialist at some €14bn, which would allow 2013's market value to smash through even the impressive €15.7bn of 2010.

So far this year, the £1.2bn IPO of car and home insurance business Esure has been the largest. The business was bought by Electra Partners and Penta Capital, which have seen it post impressive profit growth, up 110% from 2011 to 2012.

The other major IPO of 2013 is the flotation of Countrywide by Oaktree and other investors. The London listing – which gives it a market cap of £750m – marks an impressive turnaround for the estate agency group, which had seen Apollo lose much of its stake in a debt-for-equity swap after the British property market collapsed in the wake of the financial crisis. Next on the cards could be another estate agency, Foxtons, which BC Partners stuck with via an equity injection after lenders took control in 2010. It could at long last prove profitable for the backer if it goes public.

Sentiment among private equity funds regarding the public markets is likely to have been buoyed by the spate of successful exits in 2013, and this year and the next could see many companies that are reaching the end of their holding periods turn to the public markets once more.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater