Turnaround deals hit five-year low

Turnaround players assert there is a comfortable level of dealflow coming to market but the numbers tell a different story. With only five distressed purchases recorded last year, will we ever see the plethora of deals once promised? Alice Murray investigates

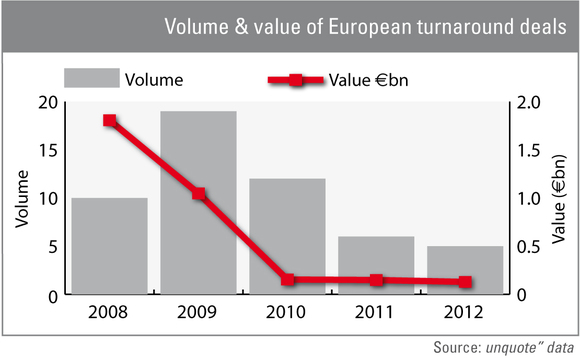

Crises often create opportunities and the economic downturn certainly gave rise to numerous turnaround funds hoping to benefit from the misfortunes of others. However, unquote" data shows the number of turnaround deals completed by institutional GPs has been decreasing over the last five years, reaching a low of just five deals in 2012.

Since the crash, LPs have piled into the turnaround space, adding more weight to the expectation that there would be a torrent of distressed opportunities. Much of the hope stemmed from the belief that banks, ill-suited to manage businesses they had acquired through loan-to-own scenarios in the post-crunch years, would offload assets into the market. According to PwC, investors have around €65bn worth of funds available for the sole purpose of acquiring loan assets from banks.

The continued low interest rate environment witnessed across Europe since the downturn is at the heart of the matter. "There are an enormous number of businesses out there that can just about pay their interest but can't repay the debt on the balance sheet," says Stuart Deacon, director at Ernst & Young who heads up the accelerated M&A team. These are the much publicised classic "zombie" firms.

Distressed activity remains muted - will we ever see the plethora of deals once promised?

However, Deacon points out that now we are starting to see businesses struggling to repay their interest. "It is only at that point that the bank needs to take some action," he adds. "That action is always amend-and-extend." Without the threat of rising interest rates, banks are happy to keep pushing maturities further down the line.

Furthermore, banks are understandably reluctant to crystallise losses. "Banks are acting benignly towards businesses," believes Nick Sanders, head of portfolio at Better Capital. "The big wall of distressed businesses hasn't materialised and the lenders are taking control of a lot of these assets."

Despite more recent examples of lenders partnering with distressed businesses in order to facilitate some sort of turnaround process, notably as RBS did with Fairline Boats, the underlying trend has been for banks to keep hold of poorly performing businesses. PwC estimates that non-core loan assets total €2.5tn across Europe, and of these, more than €1tn is comprised of non-performing loans.

This behaviour has created even more problems for turnaround investors. "The situation has now developed so that when those businesses do come to market, they've had anywhere between two to five years of under-investment, lack of management attention and shareholder direction," explains Darren Forshaw, partner at Endless. "When they are presented for sale you tend to find that buyers aren't as attracted to those investments as they would have been a couple of years earlier."

Another negative impact is businesses that were once leaders in their field are likely to have been overtaken by more liquid competitors who have benefitted from the investment and attention needed for growth and development, making the original businesses even less attractive to potential buyers.

But with such large piles of capital waiting to be deployed in the distressed market, is the clock now ticking for institutional turnaround funds whose investment periods are rolling on despite a lack of deals? According to Forshaw, this pressure to invest does not apply to the turnaround market: "It is a very specialist space. For managers without the necessary experience there is potential for mistakes to be made but there is not the same pressure to get money out of the door." Sanders echoes this sentiment: "Turnaround players are probably doing better than most and there is a steady stream of deals getting done."

Don't bank on it

Deacon points to sources other than lenders. "We have seen an uptick in deals from corporates, especially larger internationals realising they have underperforming subsidiaries." Indeed, Better Capital's recent acquisition of City Link from Rentokil Initial for a nominal sum of £1 is a perfect example. Whether through choice or circumstance, turnaround players are looking for other sources of dealflow beyond the banks.

But even if deals can be found elsewhere, distressed assets held by banks have not disappeared and lenders will have to find a way of being repaid eventually. "The current restructuring market has a very long tail and there is a huge volume of restructuring transactions that need to be worked through," Deacon points out. Rather than decreasing numbers of opportunities, the real issue in the turnaround market is one of timing: when will there be a significant uptick in activity?

According to Sanders: "It will be interest rates that will act as a catalyst to significant increases in opportunities. But also paradoxically, as banks get stronger and their balance sheets recover, they will be less inclined to keep these assets ticking over."

Another impetus could be further erosion of consumer confidence. As the bulk of distressed deals that have taken place in previous years have involved retail businesses suffering from weaker consumer confidence, a further drop in consumer spending could force many businesses into processes. "Assets that are struggling now are likely to be highly operationally leveraged, with a huge number of long-term property leases, which end up having the same impact on the business as bank debt. We are already seeing a number of retailers trying to reduce their store portfolio," explains Deacon.

Although the figures speak of doom and gloom in the turnaround market, a sense of optimism persists. Today's post-crash environment is unlike any experienced before, and while management teams and investors are right in believing that an enormous amount of non-performing assets need to be shaken out of the banks, nobody expected this level of hesitation and reluctance to act.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater