Private equity performance: looking beyond IRR

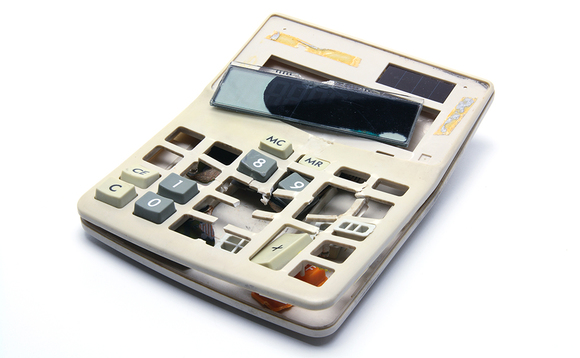

LP grumblings over the use of internal rate of return (IRR) as a performance metric begs the question of whether funds should be using the key performance indicator at all - and if not, what else? Alice Murray reports

Leading industry academics, namely Josh Learner of Harvard Business School and Oliver Gottschalg of HEC, have spoken out in recent years over the dangerous use of IRR as a performance measurement. Both have pointed to how easily the calculation can be manipulated and both have questioned its continued use. Criticism of the performance metric is fast becoming an LP concern.

"Concern over IRR has been an academic issue for many years; it is seen as a flawed measure," says Graeme Faulds, co-founder of private equity performance analysis tool TopQ, and a former LP when previously with SL Capital.

It is first important to understand why the metric is so widely used. An important feature of IRR is how well-suited it is to the asset class's modus operandi, according to Ray Chan, head of advanced analytics and performance reporting at Adams Street Partners, and also a member of the GIPS Private Equity Working Group of the CFA Institute. "Private equity is unique in that the manager has discretion as to the timing and magnitude of an investment's underlying cash flows. The decision as to how much to invest and at what time, as well as how and when to exit, are very influential in an investment's performance and should be accounted for in the performance evaluation process."

Is there a perfect fund performance metric?

However, the real trouble with the measure is that it assumes investors can reinvest intermediate cash flows and earn the same rate of return. Furthermore, varying holding periods can cause major differences in the IRR. Says Faulds: "Sometimes negative IRRs can be the inverse of positive IRRs, with larger losses appearing better if held for longer. This aspect is not well understood."

Riverside partner Karsten Langer agrees: "The main issue with IRR is if there is a short payback period (the investment was flipped), it can show as a high IRR even on a low cash multiple – so it's still a low return despite a high IRR. IRRs can distort returns." Langer points out the reverse situation means that if a company has been held for a long period but achieves a high cash multiple, the IRR will be low.

Furthermore, as IRR is calculated using a manager's own valuations of portfolio companies, the fund can appear to have a high IRR despite the underlying investments not being sold yet – there is no guarantee any given asset will achieve a GP's expected exit valuation.

Mixed measures

Faulds believes LPs should avoid looking at IRR in isolation; it should instead be viewed alongside return multiples as well as holding periods. "To really understand performance you need to look at all three," says Faulds. "It's about drilling down and finding out about deal drivers as well."

Langer says DPI (distributions to paid in ratio) is becoming a more prevalent measure, and labels it the "show-me-the-money metric" as it measures the ratio of distributions paid back to investors, giving a clearer picture of fund performance. However, even this metric has its problems: "While it is a good measure of performance, too much focus on DPI can incentivise GPs to exit too quickly."

Chan points to TVPI (total value to paid in) as a useful performance metric as it is a ratio of investment value to paid-in capital. He also highlights public market equivalent (PME) as another important metric. "PME represents the opportunity cost to an investor who could otherwise invest in a public market. For example, a PME of 7.5% for a private equity fund indicates investors would have generated a 7.5% IRR by investing the same cash flows in a public market index (the choice of the appropriate public index is an important part of the measurement). If a fund outperforms its PME, it is an indication that the investor was better off investing in the fund as opposed to the public index."

However, a drawback of PME is that under certain circumstances in can be obsolete. "This occurs when a fund outperforms the public index to such an extent that the index investment would be forced into a negative, or short, position in order to match the distributions coming back from the fund investment," explains Chan.

No one-size-fits-all

As is so often the way with private equity, there is no one-size-fits-all solution for how to best measure fund performance. Sophisticated investors therefore employ a mix of metrics, as Langer, Chan and Faulds all point out.

However, as no metric is entirely perfect, a more subjective understanding of managers is required. Using track records to predict a fund's future performance has become an increasingly dangerous game. Indeed, a recent study titled Has persistence persisted in private equity? * found that post-2000, only 22% of managers that achieved a top-quartile fund would repeat this success in the next fund.

Academics will continue to devise new metrics and increasingly complex performance calculations; and numbers will always speak volumes. In the meantime, both LPs and GPs cannot underestimate the importance of the most bespoke KPI of all: maintaining a close relationship, with frequent meetings and calls, to avoid the pitfalls of performance metrics and ensure a deeper understanding of how teams and funds work on a more personal and unquantifiable level.

*conducted by Steven Kaplan of University of Chicago; Robert Harris of University of Virginia, and Tim Jenkinson and Rudiger Stucke of University of Oxford

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater