Tech Cities: European capitals house growing number of tech deals

London, Paris, Berlin, and Stockholm have been home to one in every three tech deals in Europe over the last five years - with London and Berlin emerging as the continent's most popular destinations for private equity transactions in the tech space. Vidur Sachdeva reports

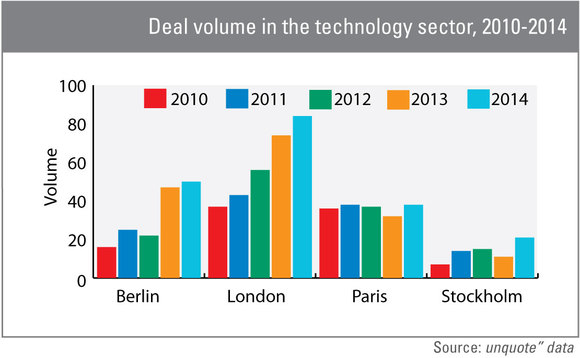

According to unquote" data, an aggregate of 96 technology deals were recorded in London, Paris, Berlin, and Stockholm in 2010. London accounted for the lion's share (39%) of dealflow with 37 deals. At 36 transactions (38% of the overall sample), Paris finished a close second, while Berlin and Stockholm recorded 16 and seven transactions, respectively.

Five years later, London has consolidated its position as the leading European city for private equity deals in the technology segment. The UK capital was home to 84 such transactions in 2014 – a growth of 227% over the five-year period since 2010 – thereby increasing its share of the total number of tech deals between the four cities from 39% in 2010 to 44% in 2014. By the end of 2014, technology deals in London accounted for nearly half (45%) of all private equity deals in the city, up from 27% in 2010.

A closer look at the data reveals that this growth can be attributed to early-stage and expansion deals. Early-stage deals in London's tech segment witnessed a rise of 254%, from 11 deals in 2010 to 28 in 2014; while expansions increased by 226%, from 23 to 52 deals. Tech buyouts in the UK capital, meanwhile, failed to report a significant increase in aggregate deal volume during 2010-2014.

During this time, Berlin outpaced Paris as the second most popular European city for private equity deals in the technology sector. The German capital recorded an impressive growth of 313%, from 16 tech transactions in 2010 to 50 in 2014. By comparison, Paris's technology sector grew marginally – from 36 to 38 deals. As a result, Berlin accounted for 26% of the total number of tech deals between the four cities at the end of 2014, up from 17% in 2010, whereas the French capital's share declined from 38% to 20%.

The rise in the number of private equity transactions in the technology sector in Berlin has primarily been driven by expansion deals, according to unquote data", up from seven transactions in 2010 to 31 in 2014. The number of early-stage deals also grew, albeit to a lesser extent, rising from eight transactions in 2010 to 18 in 2014. Buyout volume remained relatively benign, however, reporting a mere four deals over the five-year period.

The reason for the slow growth noted in Paris's tech sector is that the rise in the number of expansion deals in the French capital's technology segment (from 22 to 28 deals) was entirely counter-balanced by a decline in the volume of the city's early-stage deals in the sector (from 11 to five deals). Still, aggregate deal volume within Paris' technology sector improved marginally as the number of tech buyouts increased from three transactions in 2010 to five in 2014.

As London and Berlin continue to attract healthy levels of private equity activity in the technology segment, Stockholm has also been catching the attention of GPs. Although the total number of tech deals in the Swedish capital remains lower than the total recorded in each of the other three cities, the number of transactions in the technology sector increased sharply. Stockholm was home to 21 tech deals in 2014 – three times the volume noted in 2010. In a similar trend to that occurring in London and Berlin, a large number of transactions are expansion deals – such transactions increased from six to 14 deals during the five-year period.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater