In Profile: Sovereign Capital

Hot off the heels of its Eaton House buyout, Denise Ko Genovese talks to Dominic Dalli about why Sovereign is synonymous with buy-and-build

"We closed a deal the day after the Brexit result," says Dominic Dalli, partner at Sovereign Capital, which seems to sum up his view of the private equity landscape post-EU-referendum. "People might batten down the hatches more than previously anticipated but, ultimately, the players are very nimble and will adapt."

Indeed, the morning of Friday 24 June will not least be remembered by the GP for its acquisition of London-based independent schools group Eaton House, in a deal valued at £30m. Sovereign acquired a majority stake in the education provider, retaining its focus on the sector. Previous deals include Alpha Plus Group, SENAD and World Class Learning.

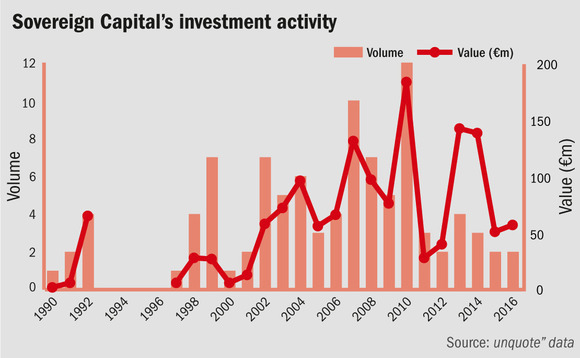

To say that Sovereign only has 19 investments currently under management from its 2005, 2010 and 2014 funds would seem very modest but also slightly misleading.

"What would be better to say is that we have done over 250 transactions over the life of the three funds," says Dalli. This paints the picture of one of the busiest firms in the industry and highlights the heart of Sovereign – its buy-and-build strategy – and the private equity house's apt strapline: "The UK Buy & Build Specialist".

"This is absolutely critical," underlines Dalli. "But what comes with it is the need for discernment, especially over how much money to commit for future acquisitions."

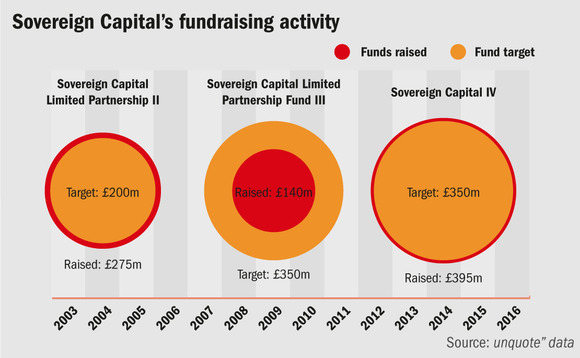

Given this investment pace, Sovereign has raised three funds in the last 11 years. Sovereign Capital Limited Partnership (SCLP) II reached a final close in May 2005 at £275m and is fully committed, while its successor SCLP III closed in July 2009 on £140m and is also fully committed. The Sovereign Capital IV fund raised £395m by final close in August 2014 (with a target of £350m) and is roughly 30% committed.

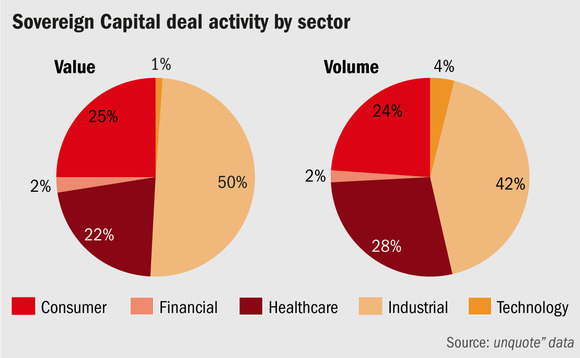

Healthcare, education & training and business services are the three sectors Sovereign set up stall with in 2001 and the ones it has kept its focus on.

Investments in the last two years include the simultaneous investments in financial administration businesses SJD Accountancy and Nixon Williams; pet group Willows Veterinary Centre and Referral Service; healthcare staffing group Nurse Plus; and supply teacher group Synarbor. Two platform investments were made this year: delivery services group Dalepak and pharma regulation consultancy business Xendo.

"Willows – now rebranded as Linnaeus Group - is a good example of having committed but undeployed capital for future acquisitions," says Dalli. "The initial capital structure will look very different going forward."

Direct origination

Sovereign has a nine-strong team dedicated to origination – a third of the investment team.

"It isn't so much that we do things off market, more that we want to identify quality businesses before they come to market so even if a process is then launched, our pitch can be further advanced," Dalli explains.

Sovereign backed the management buyout of Xendo in May this year but the asset had been on the GP's radar for some time, having approached the management team 18 months ago. Sovereign already had experience in the regulatory compliance market through its previous investments in software specialist Cordium and risk management group Alcumus.

The buyout of Dalepak in April this year was purely off market since the deal was introduced to Sovereign by an adviser, Dalli explains.

"It was a family-owned business that wanted a new management, and some PE firms shy away as they are more keen to back existing management."

Direct lenders

Sovereign is open to the ever increasing sources of finance available in the market.

"Four of the last five deals we did were supported by a direct lending fund. These lenders are good as they are transactionally motivated," says Dalli.

The Xendo buyout was supported by a unitranche from European Capital; Dalepak and Nurse Plus by direct lender Crescent Capital; and Bluebay stumped up the funds for SJD Accountancy and Nixon Williams.

"In a sense it is a borrowers' market, with increased competition between direct lenders and banks tussling for the same business causing an alignment on rates and terms," Dalli says.

The funds offer more flexibility, Dalli continues: "We approached banks with Xendo, but a fund was better placed given the buy-and-build strategy we had planned in the US," he says, adding that Xendo is already trawling the east coast for targets.

KEY PEOPLE

Andrew Hayden, managing partner, is a founding member of Sovereign and chair of its investment committee. He previously held roles at Mercury Private Equity Investments and 3i.

Neil Cox, partner, joined in 2007 after six years with Rothschild in corporate finance and as a founder of Rothschild Mezzanine. Prior to this he had a 10-year career in engineering and project management.

Dominic Dalli, partner, joined in 2002 and sits on Sovereign's investment committee. He trained as a chartered accountant with Grant Thornton and spent several years at Deloitte Corporate Finance.

Jeremy Morgan, partner, joined the team in 2013, prior to which he was at Barclays and also in industry with Pirelli Telecommunications.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds