In Profile: Rutland Partners

Now deploying its third fund, Rutland Partners' managing partner Nick Morrill believes special situations investors are more sophisticated than many realise. Denise Ko Genovese delves into the GP's track record of investment and fundraising

"Turnaround can have negative connotations and can end up sounding more financial distress than it really is," says Rutland Partners managing partner Nick Morrill. "We are special situations investors and as an asset class this includes a broad range of situations, of which operational and financial turnaround are a part."

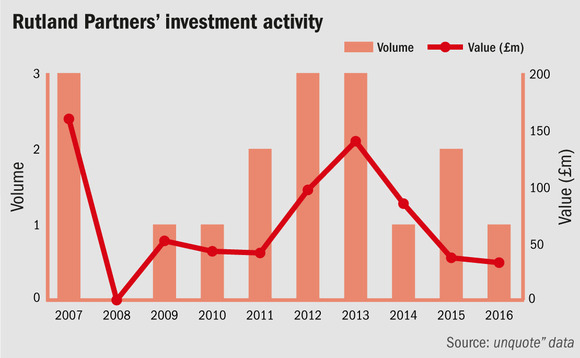

The GP has raised three pure private equity funds to date. Rutland I was raised in 2001 on £210m and is fully deployed and fully returned at over 2x money. Rutland II was raised in 2007 on £332m and is 100% deployed with five assets exited and four assets remaining – Pizza Hut, AFI, Brandon Tool Hire and Buy As You View. And Rutland III raised £263m in 2015 and is just shy of being 40% deployed.

Exits to date from Fund II are Pulse Home Products and Attends Healthcare in 2012, Cedo in 2014 and Millbrook and Bernard Matthews in 2016.

Morrill says he enjoys fundraising since it is a chance to sit back and explain what Rutland is all about and reflect on its strengths and weaknesses. "It isn't often that you get to sit around the table and look objectively at what you are doing and what you do well and not so well," he says. "But obviously when you get to the 100th presentation, it tends to get quite tiring."

The GP has a standard 10-year fund structure with a 2% fee and 20% carry coupled with an 8% hurdle criteria. Two of Rutland's deals in the last year have been co-investments – AFI and Maplin. The latter could not have been done without a co-invest because the group was fundraising at the time, says Morrill.

Identifying unique opportunities

Rutland's Pizza Hut deal typifies the GP's primary investment thesis. The fast food company was a well-known brand owned by US restaurant group Yum. At the time of Rutland's initial investment, it had 30 million customers a year with close to 300 units to its name.

The GP came to Pizza Hut at a time when the UK casual dining sector was on its 12th consecutive year of growth, but despite generating significant restaurant EBITDA each year, EBITDA was negative. Money had been taken out to develop the delivery side of the business, to the neglect of the restaurants and brand. Rutland acquired the UK group of restaurants from Yum who retained control over the delivery business and the brand itself.

"The turnaround has been a holistic approach," explains Morrill. "A financial steadying of the business through removing aggressive discounting and redeploying cash away to fund a complete revamp for the restaurants and a new expanded menu to broaden appeal. We don't shy away from things that are complicated. Our deals are typically characterised by under-investment and the wrong ownership."

After slightly more than four years, the GP is beginning to the see the fruit of its work. As of November 2016, last-12-month EBITDA for the group was £20m.

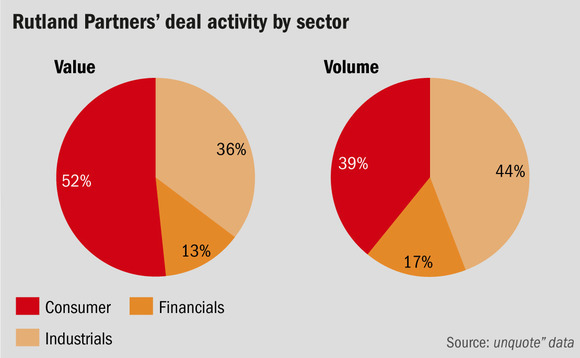

As a private equity house, Rutland sits at the small end of the buyout market. Morrill estimates that his team sees 250 deals a year but only transact two or three via £20-30m tickets. The average entry multiple is 4.5-6x pro forma year one EBITDA.

In terms of funding its transactions, Rutland has used many asset-based lending (ABL) facilities. "We are often buying businesses in unconventional spaces so it makes sense to put an asset based facility in place and refinance at a later date like we did with Pizza Hut and also Maplin," says Morrill. "ABL gives more flexibility as the security is aligned with what you own so you don't have to look over your shoulder at covenants all the time."

Key People

• Nick Morrill, managing partner, joined Rutland in 1987. In addition to group development and fundraising, since 2000 Nick has been responsible for a wide range of turnaround and restructuring investments including Interfloor, Attends Healthcare, Brandon Hire, Advantage Healthcare and Pizza Hut. He is a member of the Institute of Turnaround.

• Paul Cartwright, managing partner, joined Rutland in 1988. In addition to group development and fundraising, since 2000 Paul has been responsible for a wide range of turnaround and restructuring investments including Wolstenholme, Edinburgh Woollen Mill, H&T Group, NoteMachine, Laidlaw, Buy As You View and Bernard Matthews.

• David Wardrop, partner, joined Rutland in 2008 and is responsible for originating, evaluating and leading transactions. He has been involved in the acquisition of Brandon Hire, Pulse Home Products, AFI-Uplift and Millbrook, taking seats on all four boards.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds