Mega-buyout volumes hit post-crisis Q1 high

This week's тЌ1.58bn take-private of soft drink and fruit juice bottler Refresco Gerber by PAI and British Columbia Investment Management Corporation (BCIMC) is the 10th European mega-buyout of 2018 to date, marking the highest first quarter total since before the financial crisis.

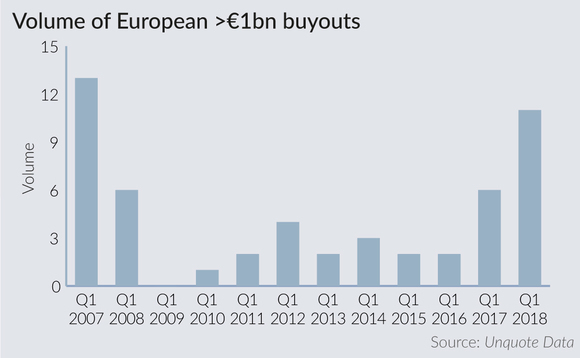

According to Unquote Data, with around one week left of the first quarter, PAI and BCIMC's buyout of Refresco means that the first three months of 2018 represent Europe's busiest first quarter for €1bn-plus buyouts since 2007, when 13 deals were announced. It is also the second highest total of all quarters since the global financial crisis, with Q2 2016 totalling 11 such deals.

The uptick in large buyouts over the past three months follows a busy final quarter of 2017, when there were eight private-equity-backed buyouts of companies with valuations north of the €1bn mark. Combined, the six-month period witnessed the highest level of mega-buyout dealflow in consecutive quarters since Q2 and Q3 in 2007. It suggests 2018 is well on course to surpass total volume seen last year, when 25 were completed.

The largest deal to have taken place so far this year is Hellman & Friedman's delisting of Danish payments service Nets, which valued the business at DKK 33.1bn (equivalent to around €4.4bn). Other notable transactions include Global Infrastructure Partners's €1.98bn acquisition of rail operator Italo-Nuovo Trasporto Viaggiatori, General Atlantic's involvement in the €1.8bn EV launch of ProSiebenSat.1 Group's e-commerce business Nucom Group, and Ardian's involvement in the €1.7bn SBO of Edmond de Rothschild Investment Partners-backed smartphone and multimedia insurance broker SFAM.

The data is all the more notable considering it excludes the recent £1.2bn acquisition of UK petrol station operator MRH by Clayton Dubilier & Rice-backed Motor Fuel Group, which is indicative of a rise in large-cap bolt-on investments.

The increased prominence of mega-buyouts comes as a number of large-cap players look to deploy increasingly large funds. Hg is the latest GP to have begun targeting larger deals after it recently launched its first large-cap vehicle (Hg Saturn) with a target of £1bn and a hard-cap of £1.5bn. Meanwhile, Apollo Global Management, CVC Capital Partners, Silver Lake and EQT have all held final closes for vehicles with total commitments above the €10bn mark over the course of the last 12 months.

It also coincides with a revival in take-private transactions by fund managers, which accounted for two of the 10 deals seen in 2018 so far and three of the 25 witnessed in 2017. In the five preceding years, a total of five delistings valued at more than €1bn took place.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds