Trade sale values boom in 2011

Trade sales continue to be the most common exit route in 2011 and increased by almost €30bn in value, while secondary buyouts are stalling, reflecting the tough economic conditions of the past year. Anneken Tappe reports

2011 was a year that disappointed with stalling or little economic growth, expensive debt and increasingly tighter regulation in the financial services sector. But while buyouts have had a relatively slow year, private equity exits have shown interesting changes compared to 2010.

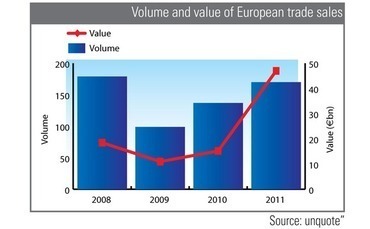

There was a general increase in the number of exits, up from 366 in 2010 to 437 in 2011, which can be the indicator of a number of things: funds nearing the end of their lifetimes, LPs demanding returns, or brushing up fund performance in otherwise poor economic conditions.

The proportion of trade sales, the most common exit route, did not change significantly between 2010 and 2011. However, the overall value of trade sales jumped from €15bn to €47bn, though some particularly large exits had a distorting effect. The biggest trade sale of the year was the €9.6bn exit from Norwegian pharma company Nycomed. The divesting parties included Nordic Capital, DLJ Merchant Banking Partners, Coller Capital and Avista Capital Partners. Nycomed was acquired by the Japanese pharma business Takeda Pharmaceutical Company Ltd.

Meanwhile, IPOs slumped in volume, going down from 21 in 2010 to just seven in 2011. Though public offerings are arguably the most prestigious exit route, it is little surprise they have suffered given the tough conditions on Europe's public markets.

The fall in value of IPOs was even more alarming, plummeting 80% to around €3bn. Though slightly higher, low appetite for flotations shows the uncertainty of the market once more. With that in mind, it is likely that this trend will continue for at least the first half of 2012.

Refinancing operations doubled in value, again proof that GPs are eager to ramp up distributions, while secondary buyouts increased by almost 50% from 2010 to 149 deals. However, despite the rise in volume, value of secondary buyouts has remained flat, suggesting much of this activity is now shifting towards the mid-market.

Economic conditions are expected to improve later in the year, which could entice PE houses to put more assets on the block - whether appetite on the buy side will come from fellow buyout players or corporates remains to be seen. With the wall of refinancing coming closer, starting in 2013, it is also likely that refinancings will become increasingly common to defer the debt burden for another few years.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds