Split in CEE dealflow leaves Russia trailing

The private equity industry in central and eastern Europe is becoming increasingly polarised, as Ukraine remains fixed in Moscow’s orbit. But while political tensions may have eclipsed Russian opportunities in the first half of 2014, other nations in CEE remain firmly on GPs’ radars. Amy King reports

"As far as Ukraine and Russia are concerned, the impact of the crisis has been clear; deals are on hold and people are very cautious. Outside of those countries, it isn't having much impact at all," says Graham Conlon, partner and co-head of international private equity at CMS Cameron McKenna.

unquote" data confirms the emergence of this bifurcation in the market, which sees Ukraine and Russia increasingly isolated from the likes of Turkey, Poland and other countries in the region. In volume terms, dealflow plummeted by 42% in Q1 2014 compared to the preceding quarter in Ukraine and Russia. But elsewhere in the region, statistics were stellar; overall dealflow peaked in Q1 2014, reaching a high point in volume terms across a five-year sample and a 38% increase on the previous quarter, according to unquote" data.

This bifurcation is expected to continue. KKR's €1bn acquisition of Serbian pay TV provider SBB/Telemach from Mid Europa in October 2013 was a stand-out moment in the region's yearbook. But will international players continue to circle large assets in the region despite political turmoil? "The big funds will continue to come for the big deals. I think we will see a few high-profile deals in the private equity market this year, I'm optimistic about that," says Conlon.

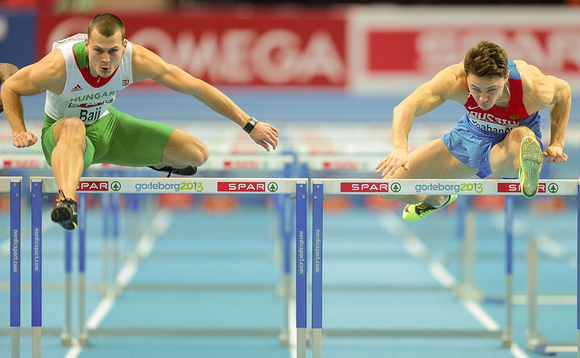

Continued political tension causing divide across CEE

Global giants including Cinven and Providence were widely reported to have circled SBB last year. Their disappointment may perhaps have been assuaged when Slovenia's economy minister, Metod Dragonja, voiced his expectation that the Slovenian government would sell its stake in Telekom Slovenia by the year-end as part of a privatisation programme. The buyout funds that saw Serbia's SBB slip through their fingers will no doubt hope to avoid going home empty handed once again, as the largest assets continue to pull in heavyweights to countries other than Russia.

Healthy interest

Indeed, Polish healthcare is continuing to pique private equity interest in 2014, with Enterprise Investors committing a further £10.5m to oncology projects in mid-May, taking its total investment in the Polish radiotherapy segment to £25m. GPs have long been attracted by the prospect of standardising the level of care across Polish healthcare providers through consolidation, and drawn by the promise of a growing middle class ready to choose private care.

Enterprise is no different: "Our investment decisions are rooted in our conviction that the Polish radiotherapy market requires considerable investment in order for this crucial form of cancer therapy to approach European standards," said Enterprise vice president Michał Kędzia in a statement. The fact that Mid Europa's Med-Sport, a Polish provider of CT scan and magnetic resonance imaging diagnostic services, attracted international healthcare giant Bupa as a buyer in 2013 will no doubt continue to boost Polish healthcare credentials.

Turkey is also continuing its ascent this year, doubling its share of CEE dealflow in volume terms in 2014 compared to the previous year – taking 11% of the pie. "But it can be challenging getting deals done in Turkey – a higher percentage than normal don't make it to the finish line," says Conlon. "It's often a question of valuation; there's often a mismatch in what the locals – frequently families that have built up and managed theses businesses – think their business is worth and what the private equity industry values the business at." Despite these challenges, CMS Cameron McKenna opened an office in Turkey last year, taking advantage of increasing opportunities in the country.

As Russian and Ukrainian dealflow grinds to a halt, other central and eastern European countries are steaming ahead. And the surprising turnaround is expected to continue: "There is a lot in the pipeline, particularly driven by funds that invested heavily in the boom years and are coming to the end of their life cycle or are looking to exit. A lot is brewing in sell-side-driven M&A," says Conlon.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater