Competition heats up for German fundraising

Deutsche Beteiligungs AG (DBAG) last week closed Germany’s biggest fund since 2007. While the country’s fundraising environment has been paid little attention in recent years, it has seen as many fund closes in 2012 as the UK. John Bakie investigates

The team at DBAG will no doubt be pleased to have raised their sixth fund in just four months after sending out PPMs, breaking the vehicle's €650m target and hitting its €700m hard cap.

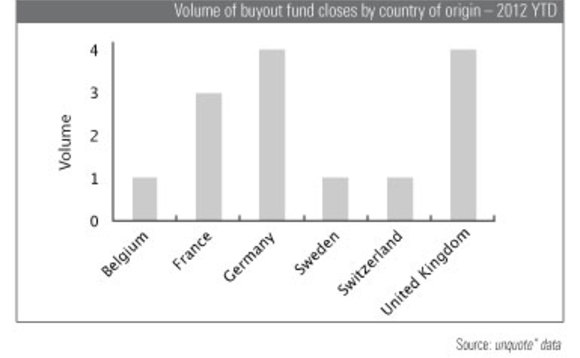

Since the beginning of the year, Germany has seen four funds reach a first, interim or final close, according to unquote" data.

This is equivalent to the number seen in the UK, and above the three fund closes in France since January. While Germany hasn't seen the sort of large fundraising that hit headlines in the UK, with BC Partners and Cinven hitting €6.5bn and €3bn respectively, the region has seen some moderate successes, indicating continuing investor appetite for Europe's largest economy.

While DBAG Fund VI is by far the largest fund closed so far this year, Germany has seen a string of more modest funds, with ECM and Perusa both successfully raising funds at around the €200m mark.

However, competition is expected to increase as a multitude of fund managers hit the market. Last year saw seven funds announced in Germany, and 2012 has seen a further seven so far, according to unquote" data.

Steadfast Capital's Nick Money-Kyrle says innovation in fundraising is vital when competing for LP commitments in Germany today.

Steadfast Fund III announced a first close in June last year at €104m; Money-Kyrle says many investors were attracted by a staple secondary, whereby new investors are offered the opportunity to obtain a secondary stake in the GP's previous fund. "Without that innovation, we would have struggled to raise a fund at all," he adds.

So, while Germany has seen a surprising number of successful fundraises so far this year, growing competition for a shrinking number of LPs could result in an increasing number of failed fundraisings over the next 12 months.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater