ECM Equity Capital Management

German health minister's 'locust sponsors' comments spook live healthcare deals

New entrants scared by remarks on limiting profits; existing investors expected to rush to complete bolt-ons

ECM buys driving school support service Academy

GP is acquiring a majority stake in the driving school support service via its €325m GEP V fund

ECM buys majority stake in YellowFox

GP is investing in the telematics software company via its €325m German Equity Partners V vehicle

ECM-backed Wieners + Wieners acquires BVIW

Wieners + Wieners was acquired by ECM's German Equity Partners IV fund, which closed on €230m in 2012

ECM acquires Piketec

ECM will use equity from its German Equity Partners V fund, which closed on €325m in June 2018

ECM holds final close on €325m hard-cap

Fifth buyout fund attracts commitments from 20 LPs from Europe, North America and Asia

Hg buys Medifox from ECM

Sale ends a five-year holding period for ECM, which acquired the business in May 2013

ECM approaches first close for GEP V

ECM targets control positions in DACH-based businesses with enterprise values between €20-80m

ECM buys Albrecht & Dill

Previous owner and extended management team will acquire a minority stake in the new company

ECM buys urology specialist Uroviva

ECM draws equity for the transaction from its €230m buyout fund German Equity Partners IV

Perusa buys ECM's steak house Maredo

GP backs the company’s tertiary buyout via its Perusa Partners Fund 2

ECM acquires Wieners+Wieners

ECM hopes to take advantage of the consolidation of the language services market

IK sells SportGroup to Equistone

Equistone will be third private equity owner of German group

ECM sells Kamps to Le Duff in trade sale

German bakery chain acquired by Le Duff Group

ECM acquires Leitner

Package tour operator market estimated to be worth €900m in Germany

ECM sells Kadi to Paragon

ECM Equity Capital Management has sold its majority stake in Kadi AG, a Swiss frozen food manufacturer, to Paragon Partners and the company’s management team.

ECM acquires MediFox Group

ECM Equity Capital Management has acquired MediFox Group, a German software provider for the care industry, alongside management as part of a succession solution.

ECM acquires Bergmann Automotive

Equity Capital Management (ECM) has acquired a majority stake in German industrial business Bergmann Automotive, alongside management and the company's family owners.

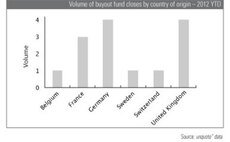

Competition heats up for German fundraising

Deutsche Beteiligungs AG (DBAG) last week closed Germany’s biggest fund since 2007. While the country’s fundraising environment has been paid little attention in recent years, it has seen as many fund closes in 2012 as the UK. John Bakie investigates...

ECM closes fourth fund on €230m

ECM Equity Capital Management has announced the final close of its fourth fund, GEP IV, on €230m.

Barclays acquires IN tIME Express Logistik from ECM

Barclays Private Equity has bought IN tIME Express Logistik from ECM Equity Capital Management.