Perusa GmbH

Perusa to exit Müpro in SBO to IK

Management of the German industrial fixings supplier will reinvest with a minority stake

Perusa eyes Müpro exit

Formal sale process is expected next year with IMs to be distributed in the first half of 2022

Perusa sells Xindao to Gilde

Perusa makes the divestment from Perusa Partners II, a €207m vehicle that closed in 2017

Perusa changes fundraising strategy

Firm has agreed an alternative funding structure with LPs, which it will review after 12-18 months

Perusa to launch third fund

Perusa Partners II held a final close on €207m in November 2011 and is deployed across 10 deals

Perusa buys Secura Industrial holding company

Secura's portfolio currently comprises two German businesses, Müpro and UBB Umformtechnik

Perusa acquires Xindao

GP draws equity from Perusa Partners II, a €207m buyout fund that closed in November 2011

Perusa buys ECM's steak house Maredo

GP backs the company’s tertiary buyout via its Perusa Partners Fund 2

German turnaround deals remain elusive

Investors divided on prospects for turnaround deals in Germany

Germany: Investor confidence is the issue, says IKB's Bauknecht

Investor confidence is the issue, says IKB’s Bauknecht at the unquote" DACH Forum in Munich

Perusa acquires décor and abrasive paper divisions from Ahlstrom

Perusa has bought the pre-impregnated décor papers and abrasive paper backings subsidiaries from fibre-based materials company Ahlstrom for €20m.

Family offices pose competitive threat to German GPs

Family offices

Perusa buys Schuberth Holding

Perusa has bought a majority stake in helmet manufacturer Schuberth Holding from investment firm Susquehanna International Group (SIG).

Sector focus: can UK manufacturing catch up with Germany?

Germany has long set the standard for manufacturing in Europe but, as the continent picks itself up from the financial downturn, does the UK have the potential to knock Germany off its top spot? Alice Murray investigates

Unbegeistert: German turnaround deals disappoint

Despite a growing number of insolvencies recorded in the first half of 2013 driven by recent changes to insolvency laws, German turnaround deals remain few and far between. Is the tide beginning to turn or will cultural issues around bankruptcy continue...

Perusa exits Kammann Maschinenbau in trade sale

Perusa has sold its 85% stake in printing services supplier Kammann Maschinenbau to corporation Koenig & Bauer.

German PE faces challenges in 2013

German PE

Perusa buys Opcon division for SEK 218m

Perusa has acquired the engine efficiency division of Opcon, a Swedish energy and environmental technology group, for SEK 218m.

Perusa-backed PPG buys Sharples & Grant

Perusa Partners-backed PPG Pet Products Group has bought UK-based pet product retailer Sharples & Grant.

DACH region turns a corner

DACH region turns a corner

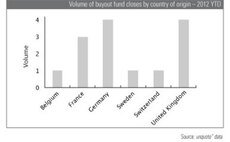

Competition heats up for German fundraising

Deutsche Beteiligungs AG (DBAG) last week closed Germany’s biggest fund since 2007. While the country’s fundraising environment has been paid little attention in recent years, it has seen as many fund closes in 2012 as the UK. John Bakie investigates...

Perusa buys TLT Group

Perusa has wholy acquired German automotive logistics business Trans-Logo-Tech Group (TLT) via its €207m Perusa Partners Fund II.