Nordic dealflow on the rise despite political headwinds

Following two years of slowing activity in the Nordic region, Q1 of 2014 has shown signs that dealflow in the region is picking up. Kenny Wastell reports

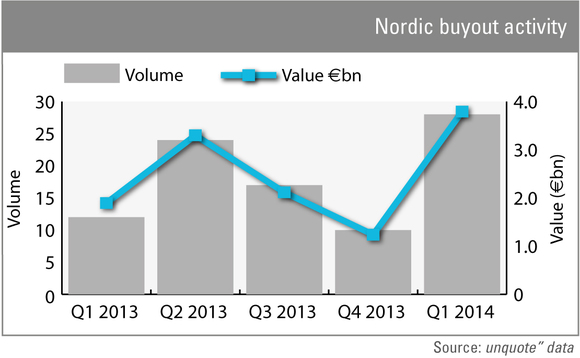

Of the market brackets in the Nordic region, buyouts in particular were at their highest level this year since Q2 of 2011, when there were 30 such deals according to unquote" data. After a brief flurry of 24 buyouts in Q2 of 2013, the following two quarters saw consecutive drops to 17 and 10 respectively. In comparison, last quarter's figures show 28 buyouts with a combined value of €3.8bn, the highest amount in almost three years.

"Activity is picking up," says Michel Eriksson a partner at EY in Sweden, "but from a low level. Overall activity in the private equity sector is still not at a particularly high level, especially in Sweden."

Eriksson's assertion about the Swedish market is backed up by unquote" data, which shows just 18 early-stage, expansion and buyout deals in Q1 of this year. This is up from 14 in the same period last year but significantly lower than the 44 of Q2 2012. The contrast between the overall deal value is almost as stark – down from €2.6bn in Q2 2012 to €752m last quarter.

Buyouts have been at their highest level since Q2 of 2011

Eriksson believes there are two main factors leading to an upturn in private equity activity more broadly. The first, he says, is a simple case of an improving economy. Second, he points to the buoyancy of the public market and its effect on exits in the region: "There is a very good opportunity now for private equity – a window to sell to the stock market. We are talking about 25 companies to list by mid-summer."

Amid the European IPO frenzy, which started gathering steam in 2013, the Nordic region can point to five such exits last year, up from none the year before. In Q1 of 2014 there were two flotations of private equity-backed businesses, most notably March's €4bn listing of Danish outsourcing company ISS, backed by EQT and Goldman Sachs.

A taxing question mark

Of particular note, the recent upturn follows NC Advisory's successful appeal in the high-profile carried interest tax battle against the Swedish tax authority last year. The original ruling against NC Advisory in 2012 would have meant partners' carried interest would have been taxed retroactively as income. The tax authority has since filed a counter-appeal with the Supreme Court. The decision as to whether or not another court case will go ahead will be made over the summer.

However, Eriksson does not see drastic ramifications for activity in the region: "Of course that is not something that helps the market, but I don't see that it's going to rock the market either. In the Nordic region we have a fairly high penetration of private equity and I do not think that will go away."

According to Eriksson, of more immediate note are Sweden's upcoming elections and the effect they may have on private equity's involvement with the welfare sector. He suspects that left-of-centre politicians may introduce bans or restrictions on profits in the sector.

With 23 Nordic buyouts, early-stage and expansion deals in the first half of Q2, the encouraging level of private equity activity in the region looks set to continue, in the face of political headwinds and thanks to the buoyancy of public markets.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater