EQT

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

IPO offers CVC chance to become multi-asset consolidator

Potential IPO also offers monetisation solution for founders and GP stakes investor Blue Owl

EQT exits Schuelke to Athos-led consortium

The Munich-based family office has been an LP in EQT's funds; joined recent co-investment tickets

EQT Mid Market exits Ellab to Novo

Sale of Danish validation solutions group follows exit of BBS Automation as GP divests mid-market fund

EQT mandates Bank of America for Schuelke sale

GP bought the Germany-based infection prevention firm from France’s Air Liquide in 2020 via EQT VIII

ESI Group draws EQT, Hg, Thoma Bravo interest

Listed French industrial software maker has drawn wide interest from sponsors and strategic players

EQT launches semi-liquid strategy for individual investors

Strategy will focus on PE and infrastructure and will be led by ex-Partners Group exec William Vettorato

Wellspect auction in final stretch with Blackstone, EQT and KKR to battle it out

Owner Dentsply launched a process to sell the Swedish bowel and bladder control products specialist in February

EQT weighs options for infection prevention firm Schuelke

Sponsor assesses quick flip for German company, acquired via EQT VIII in 2020

Germany's DFL to collect NBOs for EUR 3bn media rights stake

Large-cap sponsors including Advent, Blackstone, Bridgepoint, CVC, EQT and KKR expected to bid today

EQT exits Kfzteile24 to management, investor consortium

Sale of German car parts e-retailer wraps up EQT’s inaugural 2013-vintage Mid Market fund

Wellspect bidders CVC, KKR, PAI, EQT expected to progress into second round

US trade owner attempted a previous sale for the Swedish bladder and bowel-control products specialist in 2018

ECI reaps 2.7x return on 4ways sale to EQT-backed Evidia

Sale process for UK-based teleradiology platform had been running since September 2022

Large-cap sponsors circle Qiagen bioinformatics arm ahead of indicative bids

Potential PE bidders are assessing performance and market share of the Netherlands-headquartered business

EQT closes LSP Dementia on EUR 260m hard cap

Series A-focused fund exceeded its EUR 100m target and extended fundraising after increased LP interest in its strategy

EQT Growth acquires GotPhoto, marking fund's ninth deal

Sponsor sees attractive M&A opportunities for the growth of the Germany-based software platform for photographers

EQT Growth in active deployment with EUR 100m IntegrityNext deal

Sponsor to support organic growth of Munich-based ESG software group via inhouse digital and sustainability teams

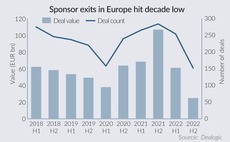

EQT faces selldown dilemma as realisation pressure dawns

Swedish GP still holds large stakes in Azelis, Suse more than 18 months after listings; could look to selldown in H2 2023

Carlyle private equity fundraising slumps behind peers

Sponsor remains on the road for its eighth flagship fund amid turmoil at CEO-level, with fundraising lagging behind peers KKR and EQT

The Bolt-Ons Digest – 26 January 2023

Unquoteтs selection of the latest add-ons, with ICG's Circet, Five Arrows' Mintec, Carlyle's Jagex, and more

German health minister's 'locust sponsors' comments spook live healthcare deals

New entrants scared by remarks on limiting profits; existing investors expected to rush to complete bolt-ons

EQT on track for 2023 final close for Fund X

GP has so far raised more than EUR 16bn for the vehicle against EUR 20bn target

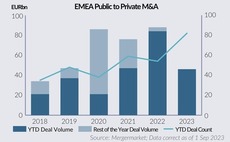

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

EQT weighs options for Open Systems including partial sale

Bank of America to prepare sale of the group's secure access service edge network division