PE-backed IPOs few and far between in 2012

Moleskine might make headlines if and when it finally lists on the stock market later this year, but flotations remained a seldom-explored exit route for GPs in 2012, continuing a trend initiated in 2008.

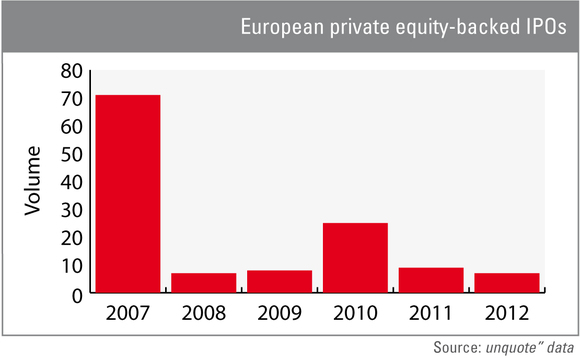

IPOs in general have had a hard time in Europe since the financial crisis and flotations of private equity-backed businesses even more so. According to unquote" data, IPOs went into freefall in 2008 to only seven listings, down from 71 at the height of the market in 2007. The following year didn't fare much better, with unquote" recording only eight IPOs of private equity portfolio companies in 2009.

Much like the rest of the private equity industry, IPOs enjoyed a spectacular recovery in 2010 with 25 companies going public – although, not all those flotations performed according to the GPs' wishes. High-profile listings that year notably included that of Axcel-backed Danish jeweller Pandora, which valued the company at nearly €3.7bn. Shares took a massive plunge following the listing however: one year later, share price had fallen by 83%. Pandora's stock has since been on the mend but remains nowhere near its initial valuation.

Dutch chip manufacturer NXP Semiconductors also floated in 2010. The IPO valued the business at $3.4bn and raised $476m. The listing however disappointed, as NXP's backers – KKR, Bain Capital, Apax Partners, AlpInvest Partners and Silver Lake Capital – originally aimed to raise $1bn.

Renewed trouble on public markets lead to a comparatively lacklustre 2011: the number of private-equity backed IPOs fell back down to only nine listings. The year did start with a bang though, when Dutch information and media company Nielsen Holdings was floated on New York Stock Exchange in an IPO valuing the company at approximately $8bn. KKR, Blackstone, Carlyle, AlpInvest, Centerview, Thomas H Lee and Hellman & Friedman had backed the company's buyout in 2006.

Last year followed in the same vein, with only seven listings being completed. German chemicals maker Evonik served as a perfect illustration of the elusive nature of successful and sizable IPOs in the current context: the company, which is 25% owned by CVC, was due to float early in the summer but withdrew its pending offer in June. This was the second time Evonik had cancelled a planned IPO, having shelved the option in 2011 already; shareholders had reportedly hoped to reach a €10-15bn market cap. That said, the successful flotation of cable operator Ziggo at the beginning of the year did enable Warburg Pincus and Cinven to reap returns of more than 4x and 2.7x respectively.

Looking ahead, Italian diary and stationery brand Moleskine is set to finally list later this year, owner Syntegra told unquote". But 2013 could also see two other high-profile private equity-backed business go public: Deutsche Annington, the German real estate group backed by Terra Firma, and Formula One Group, which postponed a Singapore flotation last year while waiting for improved market conditions.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater