CVC Capital Partners

IPO offers CVC chance to become multi-asset consolidator

Potential IPO also offers monetisation solution for founders and GP stakes investor Blue Owl

CVC raises Europe's largest ever buyout fund, securing EUR 26bn for ninth vehicle

Fund was launched in January 2023 and surpassed its EUR 25bn target, the GP said in a statement

CVC Credit targets EUR 7bn for new European direct lending fund

Fresh fundraise follows the EUR 6.3bn final close for the strategy's predecessor vehicle in December 2022

Slice of pie: New entrants gobble up GP stakes in Europe

Armen, Hunter Point Capital, GP House and Axa IM rustle up new minority investments, as Inflexion and Coller sell

Germany's DFL to collect NBOs for EUR 3bn media rights stake

Large-cap sponsors including Advent, Blackstone, Bridgepoint, CVC, EQT and KKR expected to bid today

Wellspect bidders CVC, KKR, PAI, EQT expected to progress into second round

US trade owner attempted a previous sale for the Swedish bladder and bowel-control products specialist in 2018

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

Eurazeo's Groupe Premium attracts multiple PE bidders ahead of IMs

Insurance broker has seen interest from parties including Ardian, Bridgepoint, BC Partners, Cinven, CVC

CVC acquires Scan Global logistics from AEA Investors

AEA and management have reinvested for a minority stake in the Danish logistics provider

German health minister's 'locust sponsors' comments spook live healthcare deals

New entrants scared by remarks on limiting profits; existing investors expected to rush to complete bolt-ons

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

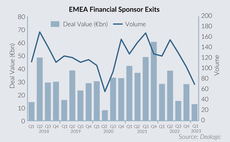

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Dyal raises USD 12.9bn for new fund with CVC, PAI stakes in portfolio

Blue Owlтs division exceeded target for fifth fund specialised in buying minority stakes in asset managers

The Bolt-Ons Digest – 14 December 2022

Unquoteтs selection of the latest add-ons, including CVC's Stark Group, Bridgepoint's Kereis, EQT's Open Systems, and more

CVC weighs strategic options for IT training provider QA

GP in informal discussions around exit or sale of parts of the UK-based company

KKR invests in CVC's French insurer April Group

US sponsor to become new majority owner; company achieved its objectives more than a year in advance

Haul of large funds closings in Q1 2023 clouds new managers outlook – conference

Good news is drop in valuations could feed good vintages in the coming years, participants at SuperInvestor tell Unquote

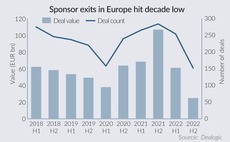

Final close: Sponsors fight through buyout fundraising drought

With EUR 100.5bn in commitments this year, European buyout fundraising is likely to be the lowest since 2018

Jewson carve-out sees Apollo, CVC, HIG, TDR in round two

Final bids for Saint-Gobain's building materials unit are due at the end of this month

CVC discards Mehiläinen exit options, focuses on growth

GP bought the Finland-based healthcare service provider in EUR 1.8bn SBO from KKR in 2018

Sika draws sponsor interest in sale of MBCC assets

Chemicals company aims to address regulatory concerns over acquisition of German peer MBCC

The Bolt-Ons Digest – 17 October 2022

Unquoteтs selection of the latest add-ons with Equistone's Ligentia, Bridgepoint's Infinigate, Ambientaтs Namirial and more

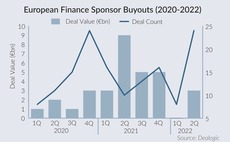

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

The Bolts-Ons Digest – 17 June 2022

Unquote’s selection of the latest add-ons with Holland's AMP, Triton's Kinios, Nordic's Sortera, Vitruvian's Sykes, and more

HG-backed Visma to divest IT consulting unit to CVC

Sponsor will invest in the carve-out from the Norwegian business software and IT provider via Fund VIII