Unquote Data

CVC raises Europe's largest ever buyout fund, securing EUR 26bn for ninth vehicle

Fund was launched in January 2023 and surpassed its EUR 25bn target, the GP said in a statement

Q1 Barometer: Signs of a brighter future after dark times for European PE

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

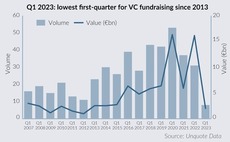

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

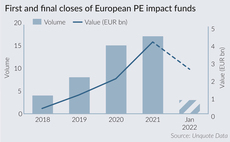

Clean capital: record impact fundraising creates pools of do-good money

Impact vehicles raised EUR 8.5bn last year, but 2023 is off to slow start with just two funds closed

Q4 Barometer: deal count remains steady amid tough environment

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Clearwater Multiples Heatmap: Valuations ease as PE deals slow down

After a record quarter, Q3 2022 sees sponsor transactions fall sharply amid challenging macro environment

Strategics pull back from PE sales as macro uncertainty bites

Share of trade exits hits lowest point in three years as corporates shore up balance sheets to navigate economic woes

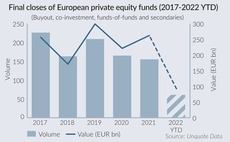

Final close: Sponsors fight through buyout fundraising drought

With EUR 100.5bn in commitments this year, European buyout fundraising is likely to be the lowest since 2018

Q3 Barometer: M&A softens across entire PE spectrum

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

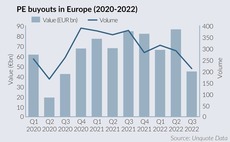

Private equity buyouts hit lowest point since COVID

Amid macro uncertainty, sponsors see EUR 44.6bn deployed across 211 buyouts, in the lowest mark since Q3 2020

Clearwater Multiples Heatmap: PE deals at record value in Q2 as macro pressure mounts

Sponsor transactions in Europe surged to an all-time high with TMT and the UK leading the way

Q2 Barometer: Value and volume bifurcation sets in

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

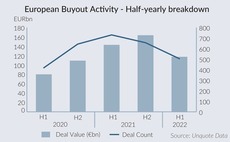

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

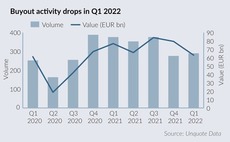

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

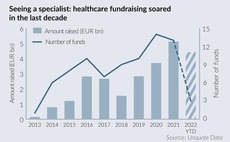

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

PE activity reaches EUR 392bn in record-breaking 2021

Q4 may have shown signs of a market slowdown, but 2021 nevertheless stands out as a phenomenal year for PE deployment across Europe

Q3 Barometer: PE scales new heights

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Average fund size reaches new heights amid stark market bifurcation

Average buyout fund close for 2021 stands at EUR 1.33bn, more than double the EUR 629m recorded in 2017