Large VC rounds: France outpaces neighbours

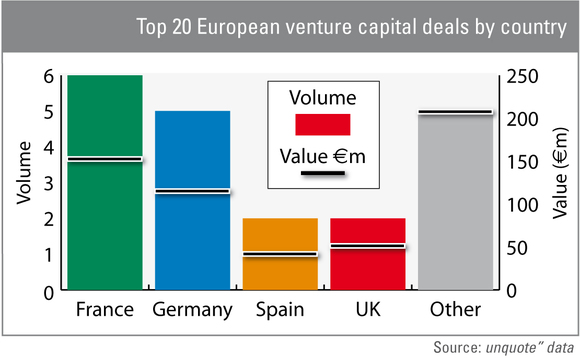

France was home to six of the 20 largest venture investments completed so far this year in Europe, with Germany following closely behind.

France was the most represented country in this top 20, with six investments worth a combined €153m. Topping the country's league table was electronic components business Crocus Technologies, which raised €34m from new backer Industrial Investors alongside existing investors Idinvest, Sofinnova Ventures, Innovation Capital, Nanodimension and Ventech in July. Russian state-backed vehicle Rusnano also contributed to the round.

Germany followed closely behind though, with the hotbed of European venture being home to five of the 20 largest transactions, worth an overall €115m. Taking top spot there was Berlin-based business software company Number Four, with Index Ventures leading a $38m series-A funding round for the company in June.

The UK, meanwhile, only contributed two deals to the top 20, on par with Spain. The former was home to a £25m early-stage round for healthcare business infirst, while online sales club Privalia, one of Spain's venture jewels, attracted a fresh €25m round.

The largest VC deal of the year so far came from an otherwise under-represented region, though: Finnish mobile games developer Supercell raised $130m from Atomico, Index Ventures and Institutional Venture Partners in April.

For a complete list of Europe's largest VC deals of 2013, head over to the App Store to download the unquote" Venture Capital Report.

All data is sourced from unquote" data, the unquote" proprietary database. To conduct your own searches on pan-European private equity trends, visit unquotedata.com

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater