UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

Terra Firma's purchase of Annington, the largest private equity-backed buyout in Europe this year, brings the total number of mega-deals (defined as those worth €1bn or more) seen in the UK this year to six.

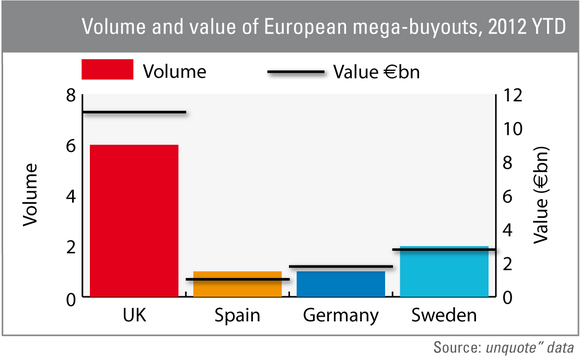

The combined value of these deals is almost €11bn, way ahead of Sweden, its nearest rival in the mega-buyout space, which has seen just two such deals worth €2.8bn.

Terra Firma's buyout of Annington also comprises the largest debt package seen this year, with a ratio of 2.2:1. The debt is a refinancing of the company's existing debt package, though given the reluctance of banks to lend in the current environment they must evidently be confident in Annington to renew its existing debt structure.

The business bought a large number of homes from the UK Ministry of Defence's (MoD) married quarters estate and many of these will be leased back to the MoD, which should provide it with stable cashflows. As the homes in its estate become surplus to MoD requirements, Annington refurbishes them and sells them on the open market.

The return of large buyouts in the UK market is yet another sign that the island nation's private equity market is holding up relatively well compared to continental Europe. Last year, there were just three mega-buyouts in the UK, while France saw five and there were four large transactions in Sweden.

Following the Annington deal, the next largest buyout was the €1.85bn acquisition of frozen food retailer Iceland Foods by South African private equity investor Brait Capital.

The business support services sector in particular has been the focus for large buyout firms investing in Europe this year. Of the 10 mega-buyouts recorded, four are offering business support. It would seem private equity players are betting that businesses will look to outsource to specialist firms in order to improve their bottom lines in times of low growth.

With little over a month left of 2012, it's uncertain whether any further mega-buyouts will be recorded. However, with several transactions rumoured to be progressing we might see growth in this market segment in 2013. Charterhouse and CVC are thought to be looking to sell Germany-based Ista for around €3bn and a tertiary buyout is not out of the question, while UK-based nuclear power business Urenco has received interest from a number of major buyout players including KKR.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds