Hold the phone: opportunities remain in German telecoms

The German telecoms and media sector saw just one deal between January and July 2014; however, it would seem there are new opportunities opening up for private equity within the space. Harriet Bailey reports

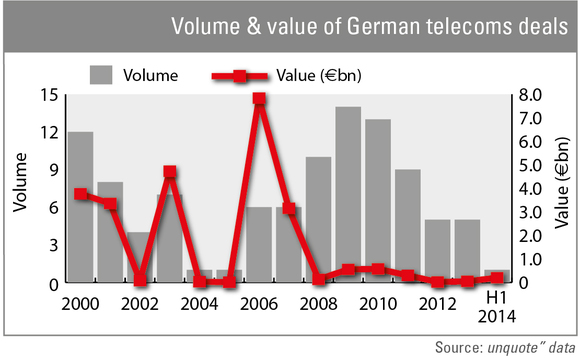

At first glance, private equity appears to have moved away from fixed-line telecommunications, broadcasting, entertainment and media agencies. According to unquote" data, dealflow in the segment has been steadily decreasing since its peak of 17 transactions in 2009. The recent lack of activity in the space could be due to the amount of consolidation that has already taken place, as well as complex competition issues.

The data reveals the telecoms segment's heyday was in the early to mid-2000s, starting in 2000 with Blackstone's €3.5bn acquisition of North Rhine Telecom Network. Dealflow reached its peak in 2006 when three deals – Providence Equity Partners' buyout of Kabel Deutschland for €3.2bn, Blackstone's €2.7bn acquisition of former national telecoms provider Deutsche Telekom and EQT's purchase of Kabel Baden-Württemberg for €1.3bn – netted a total of €7.2bn.

"Private equity was quite heavily involved in the media and telecoms area 10 years ago. Now the environment has changed," says Jürgen Zapf, managing director at Alvarez & Marsal and head of its German transaction advisory group. "I'm not sure that what happened in the 2000s will happen in the cable area again," he continues. The spate of national assets being put out to tender and the size of the companies were within private equity's reach. Now, however, the initial round of add-on acquisitions has created large corporates among which the asset class will struggle to gain a foothold.

Zapf explains: "We are seeing only a few transactions because of the fact that a small number of companies hold a large concentration of the market. You need to lift synergies and this is much easier to do if you are a corporate acquiring a competitor, rather than a private equity investor, which would typically only have one company from the industry in its portfolio." The consolidation process in the sector that took place during the previous decade has certainly generated returns, but with this the opportunities for private equity have seemingly all but been exhausted. Where does the asset class go from here?

Game of monopoly

The answer, suggests Wolfgang Büchner, partner at legal firm Jones Day's Munich office, lies in the problem. Corporate competitors are able to complete mergers and acquisitions in the sector because they can build on their existing markets and infrastructure. But, as competitors combine, the chances of their being subject to anti-trust issues increases dramatically. "One possible advantage for private equity investors is that the German federal cartel office or the EU Commission have previously prohibited acquisitions by established players because of potential market dominance," says Büchner.

Early in 2013, Kabel Deutschland attracted the wrath of the Bundeskartellamt when it planned to acquire smaller competitor Tele Columbus for around €600m. Ultimately, the German cartel office prohibited the two companies from merging as it would provide them with a regional monopoly in eastern Germany, where they had previously been direct competitors. This leaves Tele Columbus, and other companies in similar situations, open to private equity backing.

While muscling in on failed deals presents one opening into the market, it is where mergers are successful that the asset class has even more possibilities. Büchner advises looking at the conditions that enabled these deals to go ahead, as "they might include the disposal of certain operations in order to satisfy the cartel authority's conditions". Indeed, in July, the European Commission approved the merger of Germany's third and fourth largest mobile network operators, Telefonica Deutschland and E-Plus, "conditional upon the full implementation of a commitments package submitted by Telefonica", which included the sale of "certain assets". Private equity now has the chance to swoop in as the provider looks to divest a number of divisions.

Büchner feels the sector is not receiving the attention it deserves and there are more opportunities available than there appear: "We have to distinguish the market components and see that in parts of the market there are opportunities and in others there aren't so many."

Telecoms troika

Büchner defines three distinct areas: infrastructure provision, content provision and telecoms services. The latter is out, according to Büchner, being already dominated by the large providers. Within infrastructure provision, he suggests in particular looking at the cable market: "It's still fairly split and diversified, which is partly due to Germany's network architecture. There are many small regional, local players which could be a potential investment for private equity."

In terms of content provision, the major event was KKR and Permira's investment in ProSiebenSat.1. Jointly acquiring a 50.5% stake for €3.1bn from a private equity consortium including Bain Capital, Hellman & Friedman and Providence in January 2007, the backers then bought a further 12% stake later that year for more than €500m. ProSiebenSat.1 was then packaged up and parcelled off to various buyers, beginning in April 2011 when the Benelux division of the Munich-based broadcasting group was sold for €1.2bn in a trade sale. Trade buyer Discovery Corporation bought the Nordic unit in December 2012 for €1.35bn before a trio of exits of various stakes via the Frankfurt Stock Exchange in 2013, reaping more than €2.3bn. KKR and Permira fully exited the company in January this year, netting a final €1.3bn in the process.

"This is not a market for the future," warns Büchner. "The recent success of ProSiebenSat.1 was not a typical trend but was already built on diversification and they had a very good management team. It is my opinion that we will see a big push on the production side to produce interactive content and, on the provision side, to have interactive media services and gaming platforms." This opportunity has not gone unnoticed: in November 2013, Hellman & Friedman bought a 70% stake in online platform Scout24 from Deutsche Telekom for €1.5bn. Six portals – for real estate, car sales, online dating, finance comparison, travel comparison and recruitment – constitute Munich-based Scout24.

Broadband too looks like a promising area for private equity investment. The Federal Ministry for Economics and Technology has stated it sees broadband as the primary foundation of economic growth, vowing to provide financial assistance in the region of €150m to improve access. It also estimated German cable and telecoms companies will invest up to €50bn in high-speed broadband networks in the coming years. KKR, said to be considering a sale of portfolio company Versatel, which operates Germany's second-largest fibre optic network, could be looking to capitalise on this.

Eastern promise

As the German market is already highly consolidated, it may be time to look elsewhere for attractively priced offerings with room for growth. Büchner suggests eastern Europe holds some promising investment opportunities, particularly Telekom Slovenije, whose market value is in the region of €950m. According to reports earlier this year, Deutsche Telekom was said to be considering a bid for the company, but private equity is also understood to have shown an interest.

One thing is clear: private equity investors have been losing out to trade buyers who have been eating up all the smaller assets and growing fat on the profits. When they need to diet and streamline their businesses, however, the divestment of non-core assets will provide further opportunities for growth. In a sign that the asset class is becoming aware of the dearth of transactions in the space, Warburg Pincus hired German telecoms expert Rene Obermann, current CEO of Dutch cable network provider Ziggo – a former Warburg Pincus portfolio company – and previous CEO of Deutsche Telekom. Although the firm closed its Frankfurt office in July, he is said to have been engaged to find deals in both the telecoms sector and Germany.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater