Large-cap activity gaining momentum in Q2

The current quarter has been home to a welcome uptick at the larger-end of the market, both for new deals and exits, according to recent research from unquote” data. Greg Gille reports

After a very lacklustre first quarter, Q2 of this year has already shown signs of improvement in the large-cap space, boosted in no small part by healthy public market trends and plentiful financing options for GPs and strategic players alike.

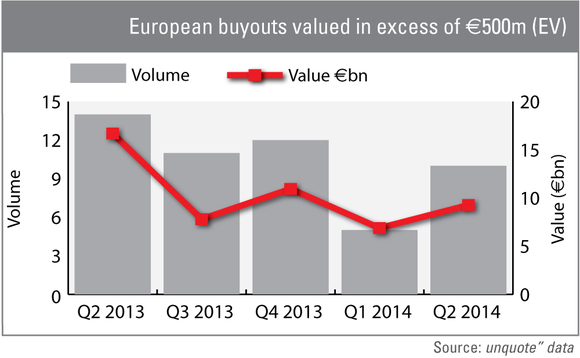

With a week left in June - and some more in-depth deal information yet to be added to the unquote" proprietary database - preliminary figures from unquote" data indeed highlight a marked recovery on the incoming investment side. The number of European buyouts valued in excess of €500m announced so far in Q2 is already double that recorded in the first three months of the year, going from five to 10 transactions. The overall value of these deals predictably shot up as well, although not in the same proportion: the second quarter has so far been home to buyouts worth an estimated €9.3bn, up by more than a third on Q1's €6.9bn.

Highlighting the fact that most GPs would rather be busy with exiting boom-year investments than making new ones at this point in the cycle, large-cap divestment activity has outpaced incoming deals in recent weeks. Unquote" has so far recorded 18 exits valued at more than €500m since April this year, up from 13 in Q1. However, overall value took a dip from €31bn to €23.3bn, although Q1 figures were somewhat skewed by the hefty €7.2bn sale of Grupo Corporativo Ono and the $7bn flotation of King Digital.

German engine

Once again, Germany has proven it is truly back in the large-cap game regarding incoming investments, since the country was home to no less than half of the 10 buyouts valued at more than €500m recorded so far this quarter. These included a trio of mega-buyouts: ICG backed the €1.3bn management buyout of Minimax from IK; Triton Partners agreed to buy the heat exchanger business of GEA Group for a similar enterprise value; and Clayton Dubilier & Rice bought industrial packaging company Mauser Group from Dubai International Capital for approximately €1.2bn.

In a surprising twist, it is not the UK that follows closely behind but France. The country has so far seen four transactions valued at more than €500m each in the second quarter, including Montagu and Astorg Partners entering exclusive negotiations to acquire Sebia Group from Cinven in a deal believed to be valued at €1-1.2bn.

The UK market has, however, taken top spot when it comes to large-cap exit activity in Q2, thanks in no small part to the frothy IPO market in London: the flotations of B&M Retail (£2.7bn) and Saga (£2.1bn) have added to what should ultimately amount to a post-crisis record tally for listings in the country. France and Germany are once again not far behind though, with five large-cap exits each against the UK's six.

While the general uptick is encouraging after the abysmal dealflow recorded between January and March - even by historically low Q1 standards - GPs and advisers should not rejoice too soon: for the most part, activity merely went back to levels seen for most of 2013 after a temporary blip.

Looking at the comparable period last year, divestment activity for Q2 2014 may well match the 19 exits valued at a collective €30.9bn recorded in Q2 2013 by the time the full dataset is available (see chart below). But bar a last-minute raft of €500m+ buyouts in the coming days, it is unlikely Q2 will match the 14 deals worth an overall €16.9bn seen across the same period in 2013.

Look out for the Q2 Private Equity Barometer, published in association with SL Capital Partners, at the end of July for more in-depth analysis of the European private equity market.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater